Learn How to Invest Private Equity

Private Equity Conference Singapore: A Professional Guide to Events, Investing, and Leading Firms in the Market

Introduction on Learn How to Invest Private Equity

Singapore has become one of the most preferred centers of private capital in Asia that has drawn in institutional funds, fund managers, family offices, and corporate strategists. To the investors of finance and operators, as well as entrepreneurs, a private equity conference Singapore or one of the more general private equity conferences Singapore is a necessary aspect of remaining competitive, finding opportunities and learning the new market dynamics. In addition to events, the presence of of solid investment ecosystem further contributes to excellent knowledge of private equity investing Singapore and has a wide selection of private equity company in Singapore structures in local growth financing up to cross-border acquisitions.

This paper offers an organized and in-depth overview of the Singapore private equity market, including key conferences and events, the basics of investing in the Singaporean private equity sector, and the nature of the companies that are the cornerstone of the industry.

1. The Role of Private Equity Conferences in Singapore’s Ecosystem

1.1 Connecting Networks and Capital Flows

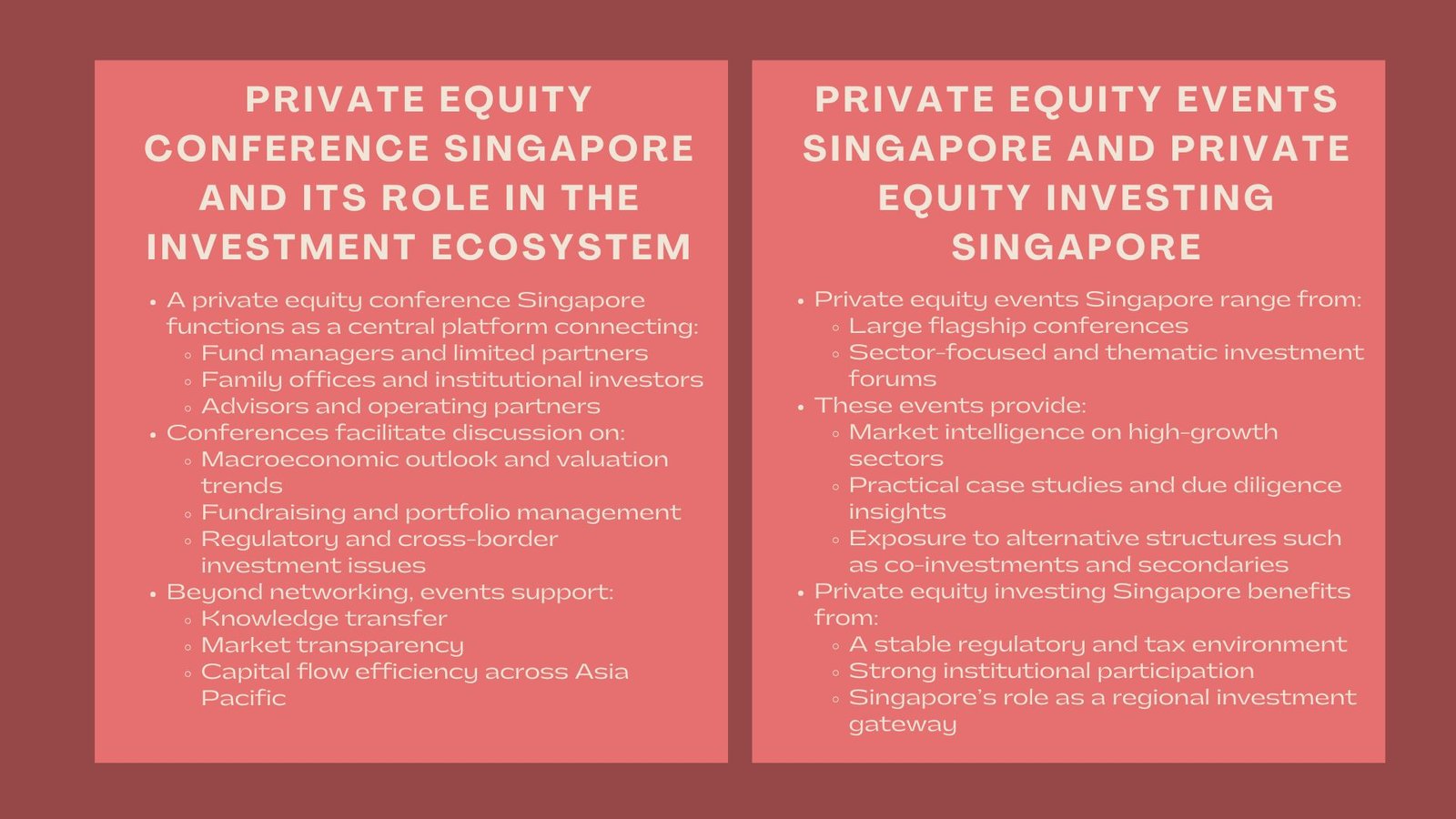

A private equity conference Singapore is a centre of industry discourse where fund managers meet limited partners (LPs), operating partners, advisors and co-investors. These conferences serve as a chance to unite different stakeholders to talk about macroeconomic conditions, the deal sourcing strategies, valuation trends, regulatory trends, and new sectors, including technology, healthcare, and sustainability.

Practically, during conferences, there will be panel discussions on how to fund-raise, how to manage a portfolio, how to exit, and how to expand into other geographical areas. The delegates enjoy global and regional knowledge about the business environment in the Asian Pacific private capital markets.

1.2 Knowledge Sharing and Deal Mobilization

In addition to networking, the events under the banner of private equity conference Singapore enhance knowledge sharing in the form of case studies, deep-dive workshops and presentations of thought leaders. These forums can be used by institutional investors in order to streamline due diligence frameworks or identify alternative frameworks like co-investments, and secondaries. In the meantime, the up-and-coming managers can obtain visibility and credibility through attending the up-and-coming manager sessions, pitch days, or thematic round tables.

The outcome is a better informed investment society that is ready to face the changing opportunities and risks in the private markets.

2. Key Private Equity Events in Singapore

2.1 Annual and Recurring Flagship Events

There are numerous private equity events in Singapore that are available in Singapore that range across generalist and specialist events. Hundreds of senior participants usually attend annual flagship conferences, which are arranged by industry associations, financial media houses or firms of professional services. Such events usually include market perspectives, regulatory trends such as tax, cross-border investment structures and the design of funds as well as real life experiences on how to optimize a portfolio.

This can be in the form of regional versions of international private capital conferences which introduce international outlook to Asian-based private equity investment.

2.2 Sector-Focused and Thematic Meetings

Besides the general events of the private equity, Singapore has smaller-scale conferences that are focused on smaller segments of the market. Topics of thematic sessions can include technology buyouts, impact investing, healthcare or life sciences deals, sustainability-linked private capital, and other alternative sources of deals, like venture debt or royalty financing.

These targeted events provide a greater level of analysis of certain areas of interest, which include practical case studies and specialized information to aid in specific investment plans.

3. Private Equity Investing Singapore: Fundamentals and Market Dynamics

3.1 Growth of Private Capital in the City-State

The private capital phenomenon has seen Singapore attracting a lot of investor money due to its reputation as a stable and well regulated and strategically located financial centre. The growth of private equity investing in Singapore has gained momentum in the last ten years through the endeavors of the government and a large scale institutional presence as well as sound legal framework.

Investors appreciate the transparent regulatory environment and capital markets infrastructure established in Singapore that enable them to raise funds as well as to deploy the private equity capital throughout the region.

3.2 Investment Strategies and Lifecycle

The investment in Singapore private equity markets is not similar; it can be characterized as either early-stage growth capital or massive buyouts and infrastructure-related deals. The capital is usually invested into the new business opportunities in well-developing sectors, business successions of families, and the consolidation plays at the region, or carve-outs by the bigger multinationals.

The process of investing in a private entity has lifecycle phases that consist of sourcing and screening, due diligence, structuring the investment, active portfolio management and finally exit which may take the form of strategic sales, secondary buy outs or initial public offering where the public markets are friendly.

3.3 Regulatory and Tax Considerations

Regulatory and tax environments should be considered by professionals involved in the investment of private equity Singapore. Singapore has good tax Environmental incentives on funds and investors, has a comprehensive double tax treaties and has clear guidelines under its financial regulatory authorities. This has aided in making Singapore a choice of jurisdiction in regard to vehicles of private capital, domiciliation of funds and co-investment structures.

4. Private Equity Company in Singapore: Landscape and Key Players

4.1 Local and Regional Fund Managers

A Singapore-based private equity firm can be either a localized mid-market firm, regional or international with the mandate of investing in the Asia Pacific. To balance between strategic focus and financial discipline, these firms tend to apply deep industry knowledge with experience in operations to introduce value in portfolio companies.

Examples of these would be medium-size companies that have targeted the growth areas in Southeast Asia, and international funds which have adopted Singapore as their Asia base to provide wider regional coverage.

4.2 Family Offices and Institutional Investors

Also among the conventional private equity funds, family offices, sovereign wealth funds and institutional LPs, which actively utilize private capital are increasing in Singapore. These bodies offer direct investment capital, co-investment or strategic partnership possibilities to the private equity sponsors.

Such a wide range of participants in the market makes the ecosystem strong, which provides sufficient opportunities to deploy capital, share risks, and cooperate strategically.

5. Practical Benefits of Engaging With Singapore’s Private Equity Events

5.1 Enhanced Market Intelligence

Participants of private equity events in Singapore receive access to the market sentiment, valuation trends, financing conditions, as well as emerging geographical opportunities in a timely manner. This intelligence helps in making improved decisions and competitive positioning.

As a case in point, a private equity specialist could hear about new tax deductions of investment in tech and changes in regulations that could impact cross-border transactions, allowing faster modification of investment theses.

5.2 Network Building and Relationship Capital

Through conferences, relationships are built quickly by interacting with peers, advisors and service providers of the fund in important components of the process of private equity origination and execution. Good professional networks are also used in finding partners to co-invest with, mentors, and strategic partners.

Professionals can also compare their practices to industry standards, which they become confident in their own methods of due diligence, valuation and portfolio management through taking an active part in the events.

6. Transitioning from Events to Active Investment Practice

6.1 From Learning to Deployment

The private equity conference Singapore or similar events can be considered a first step towards an active involvement of the individual in the private capital markets. There are often lessons learned on events that can be used by professionals to improve investment strategies, improve internal operations and develop sourcing and implementing deals.

6.2 Continuous Learning and Professional Development

As far as the private markets are complicated, constant learning is essential. In addition to conferences, professionals also make investments in formal education including private equity training courses, valuation and modelling training courses and structured infrastructure finance courses. This continuous improvement facilitates long-term career development, as well as enhances investment performance.

Conclusion

The private equity conference Singapore and the private equity events Singapore are not merely networking, but more of a strategic platform where capital meets wisdom, where dealmakers are perfecting strategies and where business conventions are being formed. These events are coupled by the wider action of the private equity investing Singapore and the existence of varied players of the private equity company in Singapore which in turn adds to the vibrant and dynamic investment ecosystem.

To gain more criteria in the private market, engaging in these platforms and aligning with local knowledge does not only increase the visibility of the market but also the depth of analyzing and gaining relationships with industry, and make the practice of investment a success in a world-related environment.