Understanding Private Equity Fund Structure and Lifecycle in Finance

Understanding Private Equity Fund Structure and Lifecycle in Finance

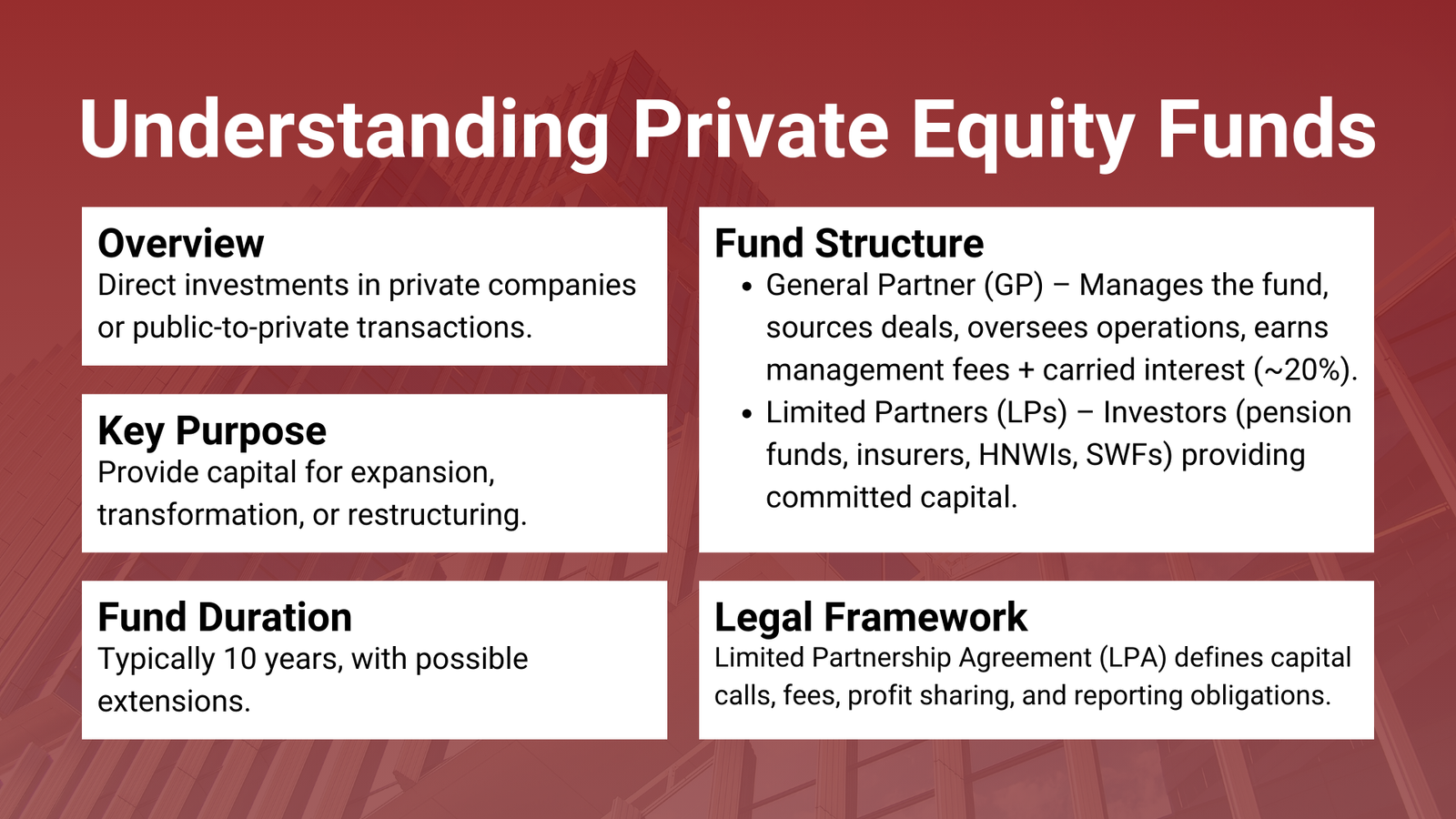

It has developed into one of the most influential investment vehicles in international business management, its role is to provide the capital and the resources needed by a company in order to expand, reform or transform. Contrary to the publicly-traded stocks market where organizations raise capital in the form of trading its stocks on the market, the process of private equity is the direct investment in any other business or a change of public companies into a privately owned company.

The nature of the funds organisation of private equity presents investors with a possibility to pool their funds in long-term investments and investors expect to generate returns once the investment is exited strategically after a set period of time. When it comes to investors and financial experts, the structure of a private equity fund as well as its lifecycle is a key to determine the level of risk and possible success as well as the overall work. For professionals looking to enter this sector, Private equity career courses Singapore provide essential training to understand fund structuring, investment strategies, and lifecycle management.

The form of a private equity fund is not merely a legal construction, it is also a strategic framework determining the mode of capital raising and deployment and exit as well. On the same note, the fundraising-to-exit lifecycle does not resemble a simple linear process in itself, although the path is foreseeable. The ability to master these factors can enable the participants to maximize the results of investments, comply with the regulatory requirements, and collocate the interests of fund managers and investors.

The Structure of a Private Equity Fund

Any private equity fund is normally put up in the structure and form of a limited partnership or equivalent in that the roles, responsibilities, and monetary rewards of the participants are made coherent. The structure has two main parties namely the General Partner (GP) and the Limited Partners (LPs). The GP is the manager, the decision maker regarding investments and a keeper of the fund, and an observer of all the applicable laws and agreements.

LPs are capital contributors to the fund, who commit funds hoping to receive returns yet play no active role in day-to-day operations. These investors can be pension funds, insurance organizations, high-net-worth individuals, or sovereign wealth funds. For professionals aiming to master such concepts in depth, enrolling in Private equity and venture capital courses Singapore can provide practical insights into fund management structures and investor roles.

Partnership agreement is the main legal document stating the terms of the fund capital commitments, management fees, carried interest, investment prohibitions, and reporting duties. The operational cost of the GP is paid by management fee which is usually a percentage of the committed capital. The use of carried interest, usually 20 or so percent of the profits of the fund after paying a preferred share of profits to the LPs acts as a mechanism of motivating the GP to maximize investment performance.

The majority of the private equity funds are fixed term, which most often lasts 10 years and have options to extend. Such structure also determines major operating policies, such as diversification policy, restrictions on type of investments, and restrictions on leverage. It is important to understand the structure of the fund since it determines factors such as risk exposure to profit distribution.

Fundraising and Capital Commitment Phase

The initiation process of the lifecycle of private equity is the process of fundraising whereby the GP tries to solicit commitments to the potential LPs. The third stage significantly relies on the reputation, history of performance as well as the investment strategy of the GP. Factors that are evaluated by LPs include previous performance of the fund, background understanding of the GP in the market, and the sector or geographic concentration of the fund.

Depending on the type of institutional investors, fundraising can consume several months or more than one year as the fundraising party is under due diligence to consider the credibility and potential of the fund. Professionals who wish to deepen their expertise in these areas often benefit from specialized programs such as a Fundraising strategies training Singapore course to understand best practices in capital raising.

At this stage, The GP provides Private Placement Memorandum (PPM) or a similar form of disclosure. This is a description of investment plan, industry sought, returns to be expected and the risk involved as well as the structure of the operational plan. The paper also gives the name of the minimum commitment amounts, capital call schedules, and the legal obligations of the two parties.

After securing commitments, the investors do not release all the capital. Rather, the GP will make capital calls, where there are investment opportunity periods, consuming the committed funds during the investment horizon. This phased capital contribution assists such that utilization of capital is optimized and that there is a matching of cash flow management between the fund and the investors.

The Investment Period and Portfolio Development

After fundraising, the fund auctions the investment phase, which takes up to four or six years. It is at this phase that the GP targets, screens and purchases companies or assets within the investment strategy of the fund. The form of the investment that is made through the association of the private equity funds is multifold and can be in the form of a leveraged buyout; investment as growth capital; investment as the acquisition of distressed assets or seeks a specific industry in which to invest.

The GP will be very proactive in finding deals during the investment period using industry contacts, investment banks, and their own research. Once a target is found, then the GP performs a thorough due diligence including financial performance due diligence, operation, and market position due diligence and growth or restructuring due diligence. The structuring of deals can usually include a mixture of equity and debt financing in an attempt to maximize returns, balancing the equity in risk management.

The GP partners with the management teams at portfolio companies to maximize value once an acquisition has been completed. It might include such strategic initiatives as operation enhancement, market growth, optimization of costs, or leadership. In contrast to the passive investors, the role of the private equity funds is active and they frequently take board seats, being involved in the decision-making gaining both practical and valuable results to improve the performance and value of the company.

The Holding Period and Value Creation Strategies

Holding period is the period between the acquisition of a portfolio company and the final exit of the same. This is the time that may take between three to seven years in relation to the kind of investment and the existing market conditions. Increasing value in the portfolio companies so as to realize better returns on exit is the main objective that the GP is supposed to pursue in this phase.

Value creation policies are diverse and might entail operational restructuring in an attempt to enhance efficiency, revenue growth programs with a view to expanding the market share as well as the financial engineering aimed at optimizing the capital structure. As in certain cases, the GP can implement bolt-on deals to enhance the competitive power of the company or even enter new spheres. The performance management and strategic direction remain the ongoing processes during this time with regular reporting to LPs on the successes and obstacles of each investment.

A successful holding period does not keep only to market conditions but rather relies on the capabilities of the GP to implement its value creating strategy. It is at this stage that the industry skills and relationship of the GP are important in distinguishing between good and bad funds.

Exit Strategies and Realization of Returns

It is at the exit stage that the fund gets the returns on its investments thus an important time in its lifecycle. Exits may be in the form of the early stage public offering (IPO), a sale to a strategic buyer, a secondary sale to another private equity firm or through a recapitalization. Exit strategy choice is determined by market conditions in addition to the performance of the portfolio company and also by analyzing the optimum time of realizing value by the GP.

A well-prepared IPO has a great potential to encompass returns and liquidity, however, it only has to be done under good market circumstances. A sale to a strategic buyer usually can fetch a premium where the acquirer believes that it can exploit some synergies through the acquisition. Secondary sales will be less time consuming and can be more complicated in negotiations. The recapitalization process will give a GP the opportunity to repay part of the capital to the LPs, but keep it as the company is interested in future profits.

Waterfall- the proceeds as a result of an exit are shared with LPs in accordance with the waterfall provision of the partnership agreement. How payments take precedence is decided in these provisions where the capital invested by the LPs first is paid back, then comes the preferred rate, and lastly, the carried interest is processed to the GP. Success and timing of exits have a direct effect on the overall performance ratios portrayed by the fund, like multiple on invested capital (MOIC), and internal rate of return (IRR).

Conclusion: Navigating the Structure and Lifecycle for Optimal Outcomes

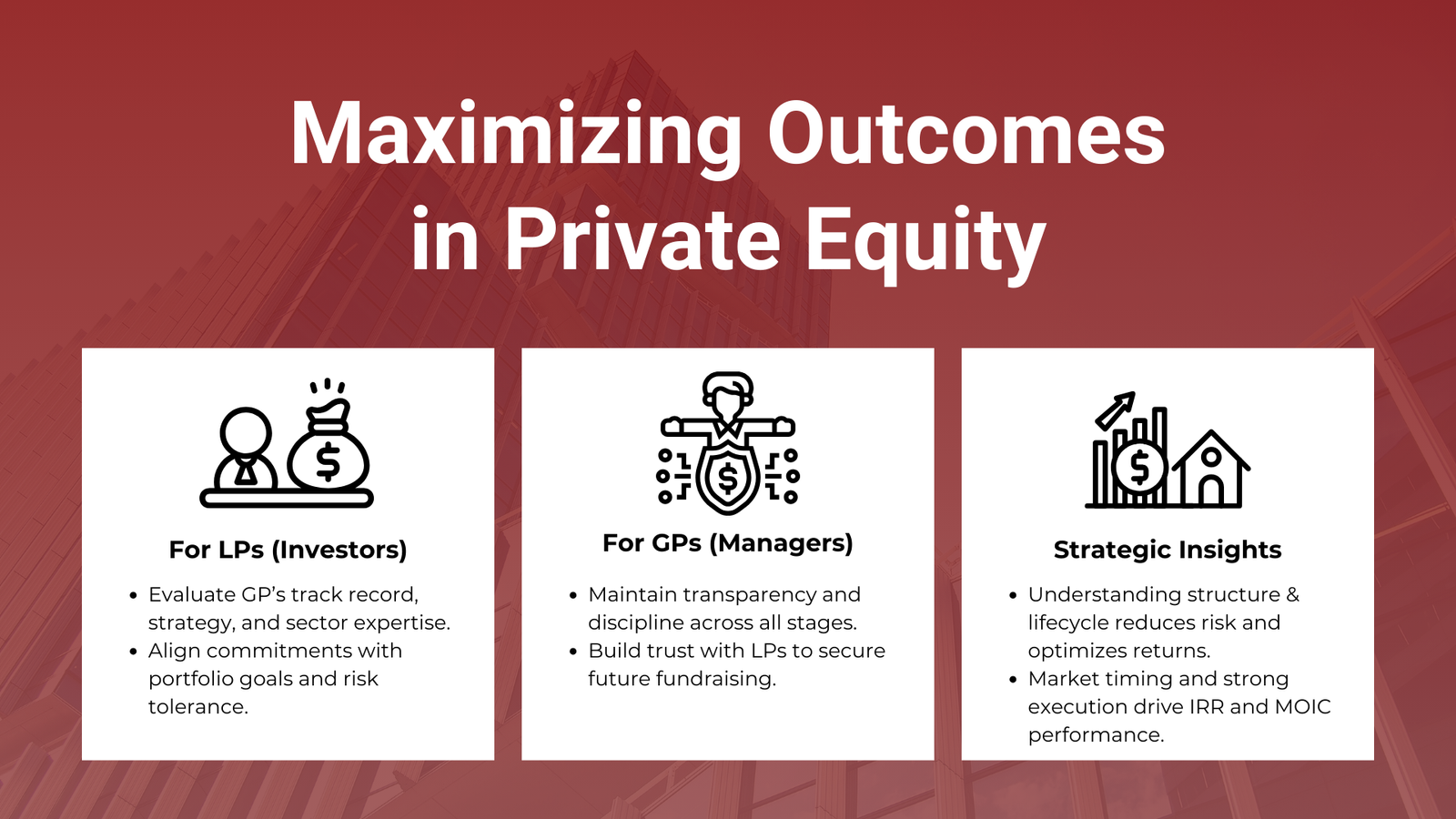

Awareness of the structure and the lifecycle of a private equity fund is vital to both an investor and the fund manager. The structural framework makes sure that roles and duties are well defined and the lifecycle stages should act like a map on how capital is deployed as well as how value can be realized. Every stage of the fundraising process through to the eventual dispensation of returns entails serious planning, disciplined actions and strategy.

To the LPs, the knowledge also allows them to judge the potential investments better and coordinate them with their overall portfolio strategies. To GPs, it forms the basis of creating lasting relationships with the investors, operational excellence and offering competitive returns. Since the nature of private equity continues to change according to the world market forces, mastering these basics still forms the key to success in the field.