Private Equity Portfolio Management Monitoring and Value Creation

Private Equity Portfolio Management: Monitoring and Value Creation

Introduction to Private Equity Portfolio Management Monitoring and Value Creation

Business success in a private equity (PE) investment does not lie in the capacity to source and/or achieve an acquisition deal but in how successful the firm manages the portfolio of investment once the deal is concluded. The portfolio is considered to be the logistical face of the privately oriented investment and it involves the quality control, operational direction and value generation through numerous investments.

Contrary to passive investment vehicles, the investment in the life cycle requires active participation in the case of private equity portfolio management and value creation strategies in Singapore. When a transaction has been made, then the actual work starts: building structures of governance, monitoring performance indicators, assisting management teams and carrying out the plans of improvement in the functioning and taking into account the return objectives of the fund. Proper portfolio management converts the hypothetical value of the financial models into an actual result of increased EBITDA growth, cash flow stability and successful exits.

This paper reveals the processes, analytical models and strategies of managing a portfolio in private equity. It looks at the way PE firms track their investments, are undertaking value-creation programs, risk management, and finally providing investors with excellent returns in a dynamic and changed global market.

The Strategic Importance of Portfolio Management

From Transaction Execution to Long-Term Stewardship

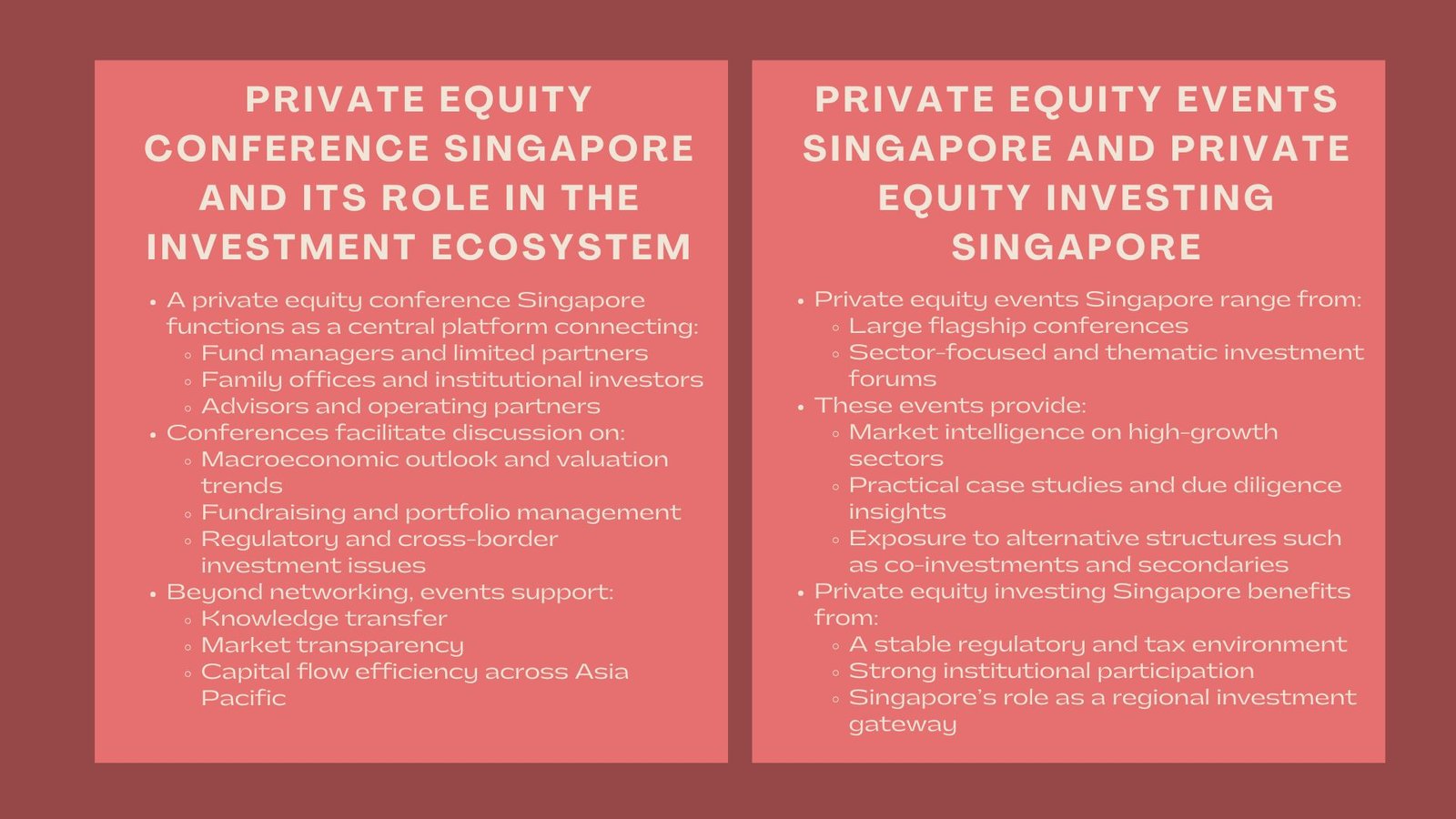

Deal-making is only a minor fraction of the private equity investing process. Although financial modeling and transaction execution receive most attention, financial sustainability of PE fund is established with frequent management and enhancement of its portfolio companies. The portfolio management process has two points of focus; addressing capital security through risk-sharing, and value-creation by promoting performance.

Portfolio management therefore plays this role as the transition between the thesis of the investment made at the time of acquisition and the actualized returns made at the time of exit. It changes and converts forms of static supposition into outputs. Having a regulated portfolio management system makes sure that every company is working on its financial goals, operating goals and strategic goals to support the necessity and performance background of the fund, a concept often emphasized in a private equity course Singapore portfolio management.

The Active Ownership Model

The nature of private equity is based on the idea of active ownership. Contrary to inhabitants of the market whose investments depend on the market performance such as public equity, privately held equity managers have direct manipulation of results since they are involved in strategic decision making. They usually occupy board seats, recruit important executives, and work together with the management groups to lay priorities. The active ownership provides PE firms to impose influence in terms of financial policies, operation implementation and governance practices.

This strategy entails capital expertise but it also needs operational acumen, industry acumen, and leadership congruence. The private equity sponsor obtains the functions of an investor and strategic partner allowing it to speed up the growth, reorganize the inefficiencies and overcome business pressures. This active ownership therefore turns the private equity into a force of carrying out transformation to the enterprise through the way of money transacting as opposed to engaging in transformation.

Framework for Effective Portfolio Monitoring

Governance and Oversight Structures

The key to the successful portfolio management process is good governance. When a company is acquired, the private equity firms will provide some form of an oversight system that will conserve accountability, transparency and strategy. This normally involves the establishment of a board of directors/ advisory committee, which consists of the representatives of the funds, independent professionals and the company executives. The board is the main decision-making structure that considers the performance measures, grants budgets and prioritizes the strategies.

Frequent contact between the PE firm and the portfolio company is very essential. Constant management reports, quarterly boarding meetings and annual strategy reviews ensure that there would be continuous visibility into the performance of the company. It is aimed at making sure that the management is doing what was agreed in the value-creation plan, rather than to micromanage operations. Effective governance models help to build trust, are nimble in decision making and are convenient in identifying the risks of life or the underperformances early.

Key Performance Indicators and Financial Tracking

The process of portfolio performance monitoring needs to be based on the data analysis and the support of the key performance indicators (KPIs). Financial indicators like revenue growth, EBITDA margin, free cash flow, working capital ratio and debt service ratio are continually evaluated to determine the financial health. Operational measures such as customer acquisition costs, churn rates, productivity ratios and market share give information on the business dynamics other than the balance sheet.

Portfolio monitoring systems how private equity firms monitor and optimize portfolio performance Singapore that are more advanced combine these KPIs into dashboards that can be used to track them in a real-time mode. This will enable the managers of the private equity to determine the actual versus the projected results of the original investment model. Deviations cause reevaluations and mitigation measures to stay on track of performance variations and ensure before they diminish value. This analytical rigor also makes monitoring a more active tool of management rather than a passive reporting tool that informs and reaches strategic decisions.

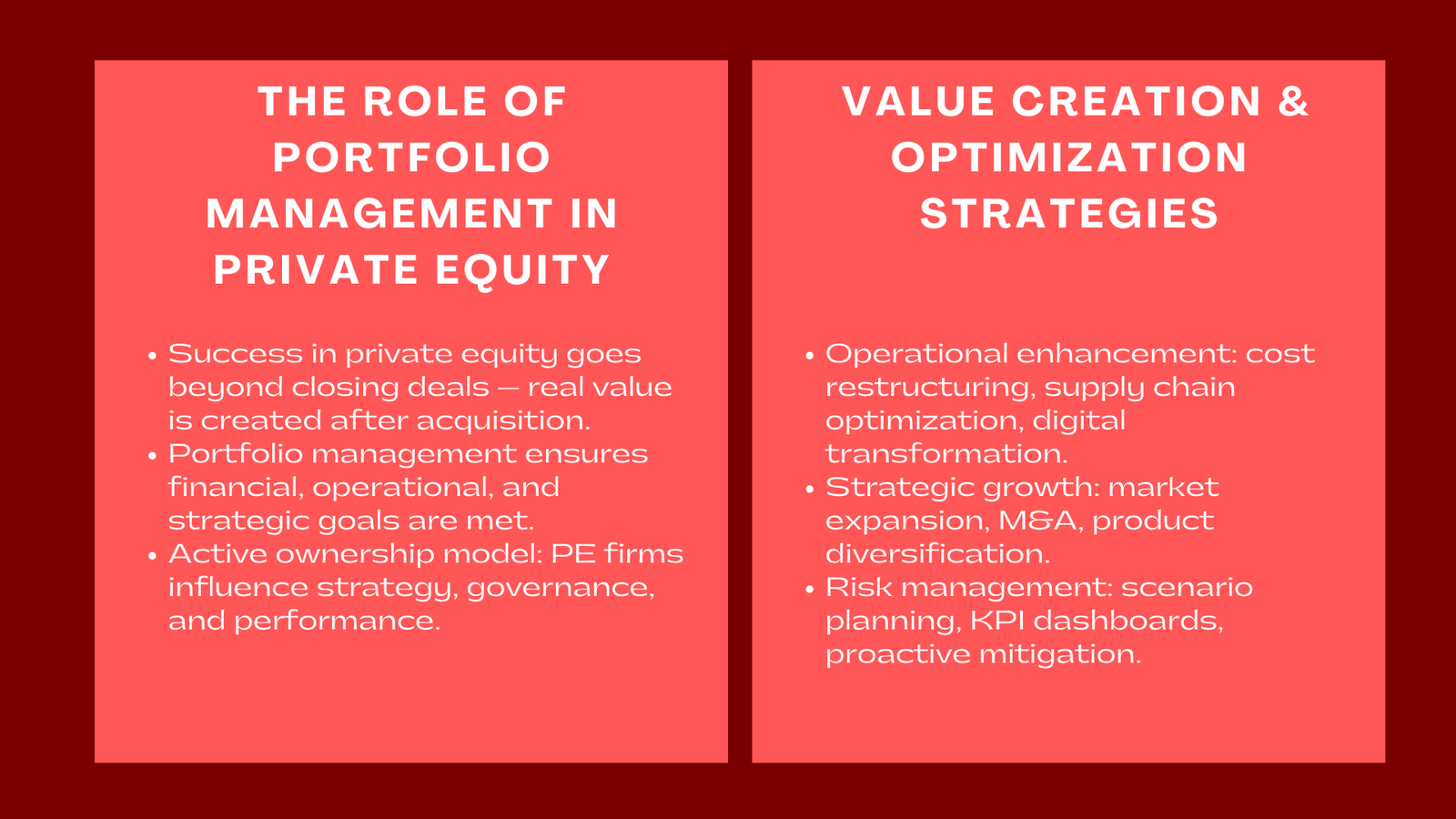

Risk Assessment and Scenario Planning

As a part of portfolio management, risk management is established. Every investment is different in terms of risks, either macroeconomic, regulatory, competitive, or operational risks. Scenario analysis is also used by the managers of private equity to challenge the strengths of the portfolio companies based on any scenario. When they model base-case, downside, and stress-case scenarios, they can make simple estimates on the impact that any of them might have on cash flows, leverage ratios, and exit valuations.

Frequent risk evaluations would be useful in prioritizing the way on mitigation measures like diversification of revenues, debt refinancing, or adoption of hedging policies. In the modern inter-marketed markets risk management is in proactive mode that not only holds value but also builds investor confidence in the fund in terms of good governance and stewardship.

Value Creation in Private Equity

Operational Enhancement as the Core Driver

The hallmark that is most differentiating amid the private equity portfolio management is the focus towards value creation in operations. Financial engineering is no longer an assurance of success to operate in an environment that is marked with a smaller margin and increased regulation. Rather, the objective of the private equity companies is bettering the business performance of the companies that they are invested in.

Some of these initiatives could be operational enhancement such as cost rationalization, supply chain optimization, digital transformation and product innovation. Through streamlining of operations, technology advancement and enhancement of the operational efficiency, profit margins and cash generation can be enhanced by the owners of the private equity. The power to find and implement these operational levers is the distinction between the high performing funds and those funds that depend on financial leverage only.

Strategic Growth and Market Expansion

Value creation also entails the strategic expansion opportunities in addition to the enhancement of operations internally. The involvement of the sponsors through the private equity helps the management to review possible mergers and acquisitions, expansion into different geographical areas, or new product lines. These plans are expected to add value to the enterprise by raising revenue, and leading the market.

Expansion plans are generally championed with elaborate feasibility examination, funds allocation methodology, and performance indications. Allowing the alignment of the management incentives and growth outcomes, the private equity firms will have made sure growth efforts are always kept under control, factual and additive to shareholder value.

Human Capital and Management Alignment

It is impossible to have a value-creating strategy that is successful without leadership. The private equity firms understand that effective management teams are useful in implementing agendas of transformation. As a result, they tend to take extensive evaluations of the leading ability and organizational culture after the acquisition. In situations where needed, the sponsors will get in new executives who have a good track record in scaling their operations or carrying out turnarounds.

Incentive systems are also extremely important. The management compensation packages are often pegged on performance indices like growth in EBITDA or increase in the value of the equity. This co-ordination of interest makes the management and the investors pull together in achieving the end goals together which strengthens accountability and devotion in the holding period.

Tools and Techniques for Portfolio Value Optimization

Data Analytics and Technology Integration

The current strategy in managing private equity portfolios focuses more on the use of data analytics and digital tools to improve decision making. Complex platforms combine financial and operational data of a portfolio company, which allows discerning patterns, benchmarking, and predictive analysis. Such insights assist in determining the trends of performance and avenues of cross-portfolio synergies.

To illustrate, a private equity company can identify supply chain inefficiencies manifesting in a number of its companies, and roll out a common set of procurement systems to lower expenditure. Likewise, digital transformation plans like automation, ERP applications, and AI forecasting make work more accurate, have less human error, and shorten reporting periods. Through including technology into the management of a portfolio, a firm in the private equity will become efficient and strategically farsighted.

ESG and Sustainable Value Creation

The ESG aspects have become an important part of long-term value creation. The increasing demand on sustainability on the part of institutional investors is that private equity firms need to consider sustainability as part of their portfolio strategy. This will be done through measuring the environment, maintaining ethical labor standards, and good governance in portfolio companies.

The integration of ESG principles into operation systems contributes to the reduction of reputational and regulatory risks, but also to the creation of new value of the company, which is organized by the private equity firms. Sustainability is able to increase brand perception, decrease the expenditure due to energy-saving, and gain access to consumers and partners that are socially responsible. ESG integration is not a marginal issue anymore, as international capital markets develop, but one of the characteristics of proper portfolio management.

Exit Preparation and Realization

Good management of a portfolio also involves that one should plan on leaving in advance. Immediately an investment is made the exit roadmap will be designed by the sponsor in the private equity organisation on the type of potential buyers, target valuation range, and timing, among others. During the holding period, the attention is given to the creation of the company that is appealing to the acquirers or public investors.

The final preparation must be documented carefully, show reports, and the provision of operational improvement. The exit process, be it in the form of a trade sale, a secondary buyout, or as the initial offering of stocks, is just the end result of an application of years of strategic and operational launch. The portfolio management to achieve the best value of exit to both the general partners (GPs) and limited partners (LPs) is realized.

Strategic Dimensions and Evaluation Approaches

Balancing Oversight and Autonomy

The need to manage autonomy versus the level of supervision is one of the long term issues in portfolio management. Too much interference may suffocate innovation and the decision making process and too little may result in strategic drift. The best private equity companies adopt a balance of power attitude in which they offer their strength and advice, but give the management the space to manage things as they wish without any restrictions that go beyond the acceptable limits.

This balance gives rise to the culture of responsibility and empowerment. The trust of the capable management and the strict supervision make the environment allowing the private equity owners to be creative, disciplined in their operations, and able to sustain in the long run.

Institutional Learning and Cross-Portfolio Synergies

Portfolio management is becoming a source of institutional learning to a significant number of leading private equity firms. Through their multiple investments, they would be able to analyze their performance and be able to identify the best practices that would be replicated in other portfolio companies. Exchange of knowledge and cooperation among management teams encourages inception and speed of addressing problems.

Value creation may also be increased through cross portfolio synergies (through common procurement, joint marketing, or joint R& D activities, and so forth). The institutionalization of such practices will turn portfolio management into a proactive ecosystem of continuous betterment as opposed to an element of a reacting process.

Driving Value and Institutional Growth

A successful portfolio management has a trickle down effect on the stakeholders involved. To the investors, this means a stable payoff, lesser volatility and better multiple out of exit. In the case of portfolio companies, it avails strategic competencies, capital bases and performance discipline. On an institutional scale, it helps in reinforcing credibility of a fund, improving the relationship with the limited partners as well as developing a record of sustainable value generation.

In addition, healthy portfolio management can help in economic development through enhanced efficiency in business, job creation and innovation. The latter will persist in the ability to manage portfolios dynamically and strategically, as the private equity continues to transform, it will be the factor that will keep determining the difference between the performance of the best funds and the rest.

Conclusion

Portfolio management in the case of private equity is not an administrative activity at all, it is the strategic core of the investment process. PE firms change businesses by means of disciplined monitoring, proactive governance, and create value through precise targeting, which, in turn, is likely to warrant illiquidity and complexity of the asset class.

In a time when financial engineering is no longer an adequate tool, operations excellence, technological integration and stewardship determine success in the private equity industry. The future of portfolio management is a blend of both analytical and human intelligence – not only numbers, but people, strategies and journeys of change are managed. After all, the worthiness of a particular private equity fund is gauged not by its deal-making but by its long-term value-generating portfolio.