Private Equity Fund Lifecycle Explained Clearly with Examples

Learn Private Equity Fund Lifecycle Explained Clearly with Examples

Private equity has gained eminence to be among the influential forces in world finance that has resulted in capital being directed to businesses with the intention of releasing value and making high returns. The personal investment strategy is centered on the private equity fund that revolves according to a specific lifecycle. It is important that the investors or fund managers or the entrepreneurs or the professionals interested in alternative investments understand this lifecycle. The lifecycle of a private equity fund has a natural flow in terms of how the fund raising, investments, value creation and exit strategies can be balanced, although the specifics of implementing a private equity strategy can vary.

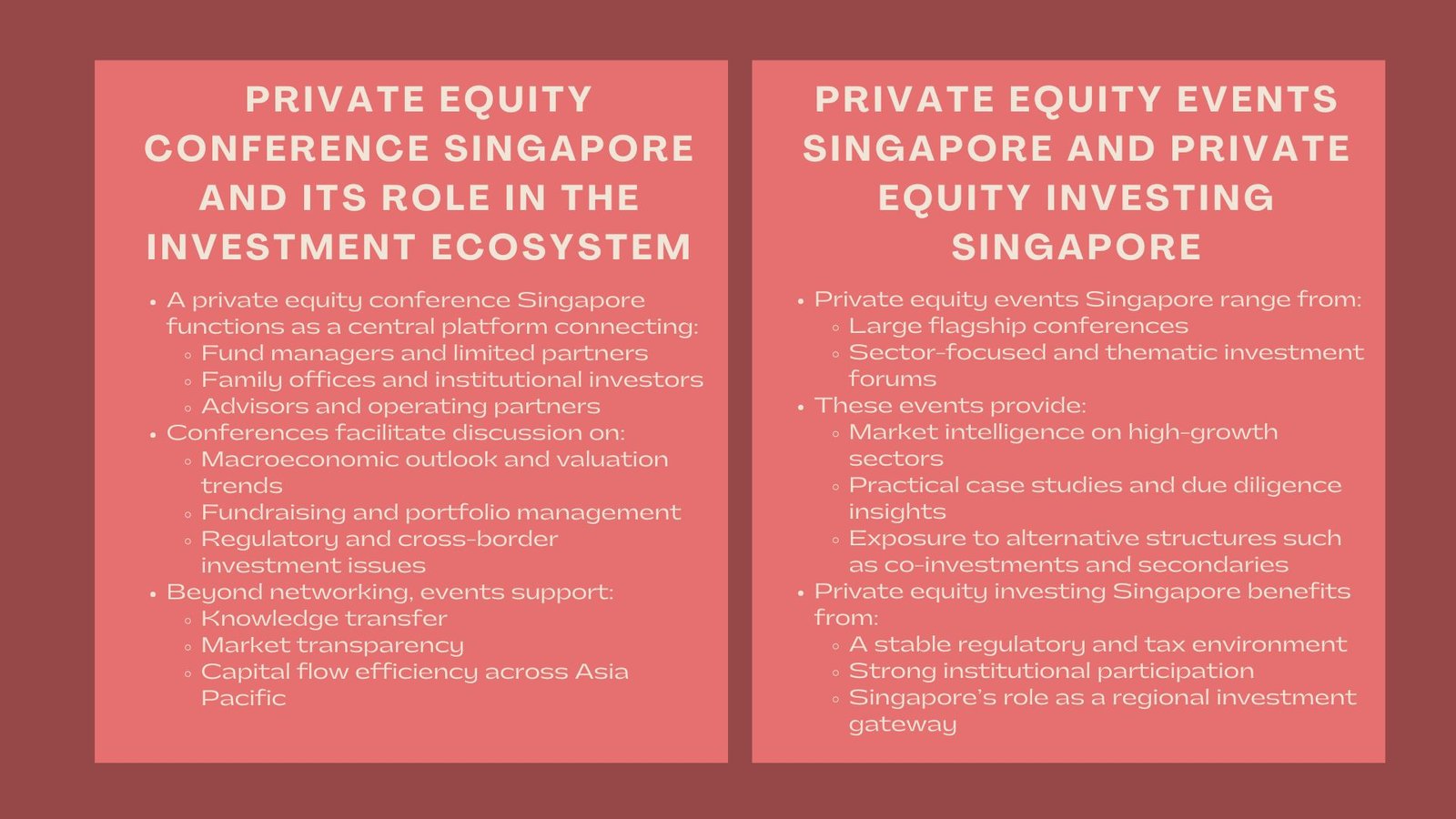

This paper will examine the lifecycle of a private equity fund, parsing out this timeline into different stages, the dynamics that spur and support each, and what they mean more generally to investors and business owners alike, insights often explored in a Private Equity Valuation and Deal Structuring Course in Singapore.

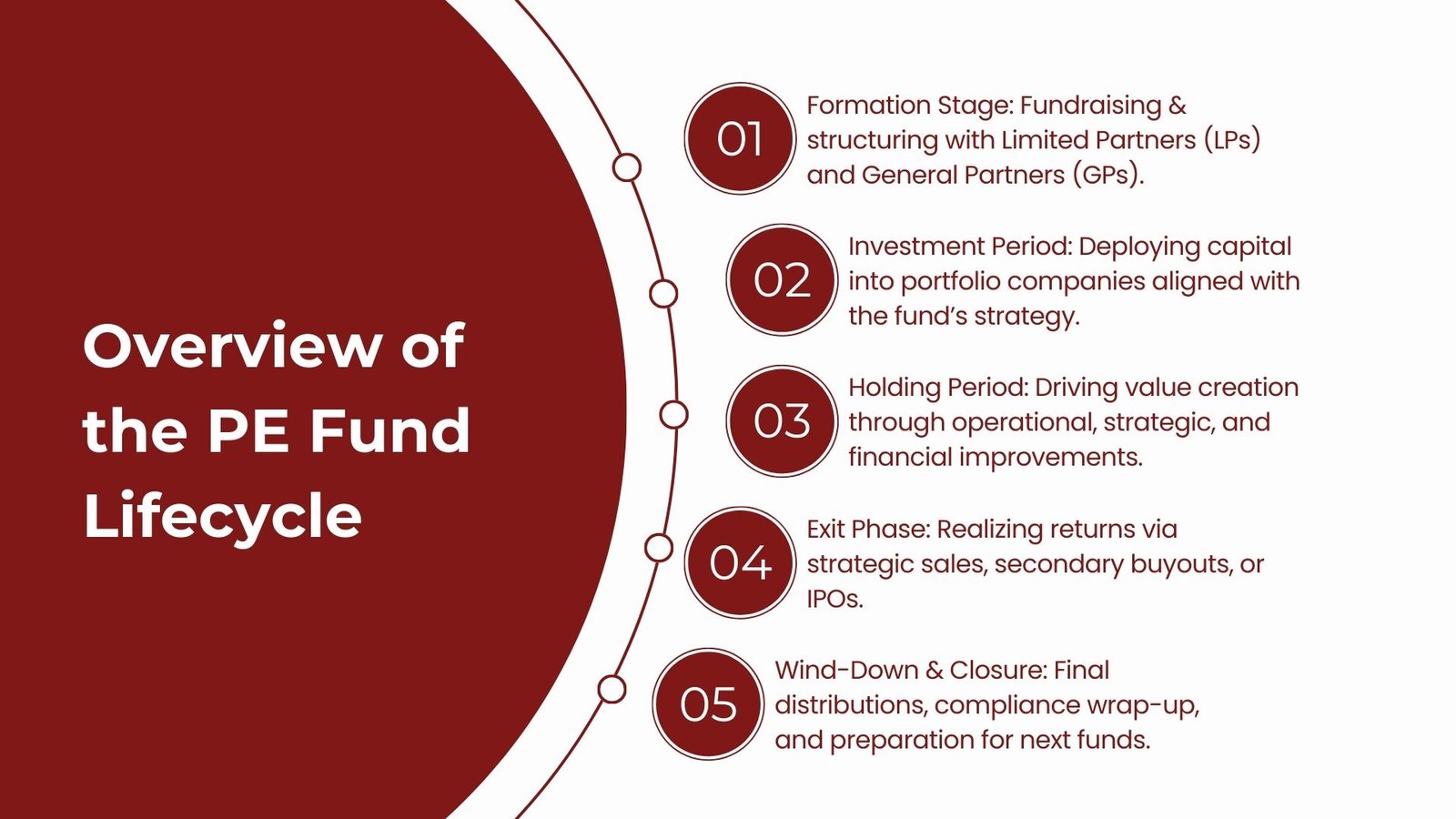

The Formation Stage: Fundraising and Structuring

The initial phase of the lifecycle of a private equity fund is the creation process that should start with the fundraising and structuring. At this point, this firm, which is also called fund management firm, solicits investment commitments, or limited partners (LPs). These LPs could be as requests which could be institutional investors like pension funds, insurance companies, sovereign wealth funds, university endowments and rich individuals who want to get exposure on the alternative investments.

Fundraising involves preparing an interesting investment thesis by the GP. In this thesis, the type of companies or industries that the fund will target, region of interests and the strategy to be used to generate returns will be presented. In one scenario, the Fund targets early-stage growth companies and another targets distressed assets or mature companies looking to be restructured.

The GP also has to structure the fund, the usual form of which is a limited partnership in conjunction with the investment thesis. The GP takes the responsibility of the fund management and investment decisions, and the majority of the capital is put in by LPs in which they become passive participants. The rights, obligations, fees and the arrangements of sharing profits are agreed upon in an agreement known as a limited partnership agreement (LPA).

The process of fundraising may also entail an extensive roadshow wherein the GPs present their pitch to prospective investors, respond to questions on the risks in their management, and show a record of previous performance in the case of prior experience. In the case of first-time funds, persuading the LPs may be hard, since the latter can only count on the reputation of managers and not a long performance experience. The fund is formally fixed once commitments are secured, the fund becomes legally established and funds become gradually drawn down by the LPs as investments are made. These processes are frequently examined in a Fund Raising Course with Real-World Financial Case Studies.

The Investment Period: Deploying Capital

After launching the fund, it will enter into the investment period which may span within three to five years. The GP uses this period to source, screen and invest in portfolio companies that are in line with the strategy of the fund. Not only financial expertise is demanded in this step but also an in-depth knowledge of industries, markets and operational enhancements.

The new GP will take strict due diligence prior to executing an investment. This is done through analysis of financial statements, business strategies, competitive playing, regulating risks and management teams. Due diligence helps to limit dilutions in investments to those that match the fund thesis and which can actually yield high returns.

No investing of capital is made at a blow. Rather, it is pulled-in as required by LPs. This construction makes sure that the investors are not obliged to tender their money openly over the whole fund existence and provides the GP with the alternative to place capital effectively.

Depending on the specialization of a fund, the investments can be varied in their form. As an illustration, in a leveraged buyout (LBO) fund will purchase majority shares in some well-established businesses; in many cases by leveraging its financing with debt. In growth equity the fund contributes capital to businesses that are growing without assuming complete control. In venture capital, the capital invested focuses on startups in the early growth stage that also carry a higher degree of risk due to huge growth potential.

Towards the end of the period of investment, the fund usually develops a diversified portfolio of firms. It aims at aggregating risk on the one hand and setting the investments on an apt path to build value and eventual exit.

The Holding Period: Value Creation in Portfolio Companies

The next phase is the holding stage after the investment horizon, which lasts five to seven years. Over this period GP is concerned with maximising the value of portfolio companies. This is where the private equity funds stand above passive investors.

Value creation strategies are diverse and usually involve operation enhancement, strategic direction, and financial restructuring and perhaps a leadership change. To give an example, a private equity fund can consolidate activities, get into new markets, engage in the digital transformation or streamline the capital structure to save on costs and increase profitability.

The ownership of a private equity investment is participatory as compared to investing in a public market. Sometimes GPs take board positions in portfolio firms in order to directly interact with decisions. They can use new executives, develop partnerships, or use the power of industry knowledge to increase growth.

It is vital to hold this period since it allows in lining up the company performance with the overall objectives of the fund. Since the average life of the private equity funds is about 10 years, the improvement timeline is clearly defined. The GP needs to orient each company towards an effective exit, either by using an initial public offering (IPO), by selling it to another private equity firm or to an acquisition by a strategic buyer.

The Exit Phase: Realizing Returns

The last step of the lifecycle of the contributors is the exit phase. The most crucial thing is exits as they translate the paper gains into the realized returns that will be shared between the LPs and GPs in ratios as stipulated in the partnership agreement.

The exit ways are manifold with its own benefits and disadvantages. Selling a portfolio company to a strategic buyer is one of the most frequent, but in many instances, becomes another company in the same industry, this time to take the advantages of synergies or market penetration. The common alternative is selling to other private equity funds which is known as secondary buyout. The strategy would enable the firm to change its ownership and adopt a new method of value creation.

Another good exit strategy is an IPO which can be even more successful when the market condition is fine. Listing could bring a high return to a company, yet it has an increased market and regulatory risk. Partial withdrawal In a few instances, private equity firms can use a method called partial exiting or partial selling of shares to achieve returns and still feel like they own shares.

Time is a major aspect of the exit procedure. The problem with an early exit is that a lot of value might not be realized and a delayed exit can also expose the firm to economic or industry changes. An important measure that GPs should take is to review the market conditions, company performance coupled with investor expectations, to ensure that they find the best exit window.

When the exits are arrived, the proceeds are disbursed. GPs generate management fees and carry interest, and LPs get most of the profits in a standard set up rewarding the GP with an interest in the profits after a specified level of returns is achieved.

Wind-Down and Fund Closure

Wind-down and closure is the last stage of a private equity fund after the exit stage phase. By this time, investments have been largely liquidated and the remaining capital of the fund has been allotted. The GP ascertains that all the requirements are fully met such as financial reporting, auditing, and regulatory compliance.

Closing of funds is not only administrative, but there is also a reputation to take into account. The success by a GP in managing a fund through its lifecycle influences the credibility of getting its subsequent funds. Past fund performance is an important determinant of investment behaviour and as such, closure is vital in long-term relationship sustainability.

Also during this stage GPs can start raising new funds using the track record they have to get new commitments. A single investment fund lifecycle can overlap with the fundraising and the initial investment phases of other funds thus in many cases there is a continued cycle of capital deployment and generation of returns.

The Broader Implications of the Private Equity Fund Lifecycle

Knowledge of the lifecycle of the private equity funds is not just fundamental to investors but also to the business and professionals. To LPs, it demystifies the expectations of capital commitments, liquidity and the future returns on investments. To entrepreneurs and executives, it offers an understanding of what private equity investors are looking for in the portfolio companies and how they can provide the growth opportunity. This essential knowledge is often covered in a Top-Rated Private Equity Course for Finance and Investment Professionals.

Besides, the lifecycle model supports the element of timing and strategy in alternative investments. The functions of private equity are finite dated in which GPs must find the right balance of opportunity and risk at every level. Based on the point of view of the financial system, the involvement of private equity in efficient capital allocation, innovation and industry reshaping through active ownership and operational enhancement is critical.

Conclusion

The life cycle of the private equity funds is a well-established process of fundraising and investment, value addition, exit and closure. Although each such strategy and its outcomes are different, the framework prevalent in the industry is common. They are also different skills and decision-making required in each of the phases but still interrelated towards accomplishing overall success of the fund.

In the case of investors, knowledge of such a lifecycle helps in providing clarity in time and manner in which returns can occur. To fund managers it can be a path map to value delivery. And to businesses, it points to the distinctive contribution that private equity can make to growth and change.

Through the de-mystification of the private equity fund lifecycle, stakeholders will be in a better position to cut through the complexities of alternative investments and utilize the opportunities that they become open to.