Introduction to Private Equity and Its Strategic Importance

Introduction to Private Equity and Its Strategic Importance

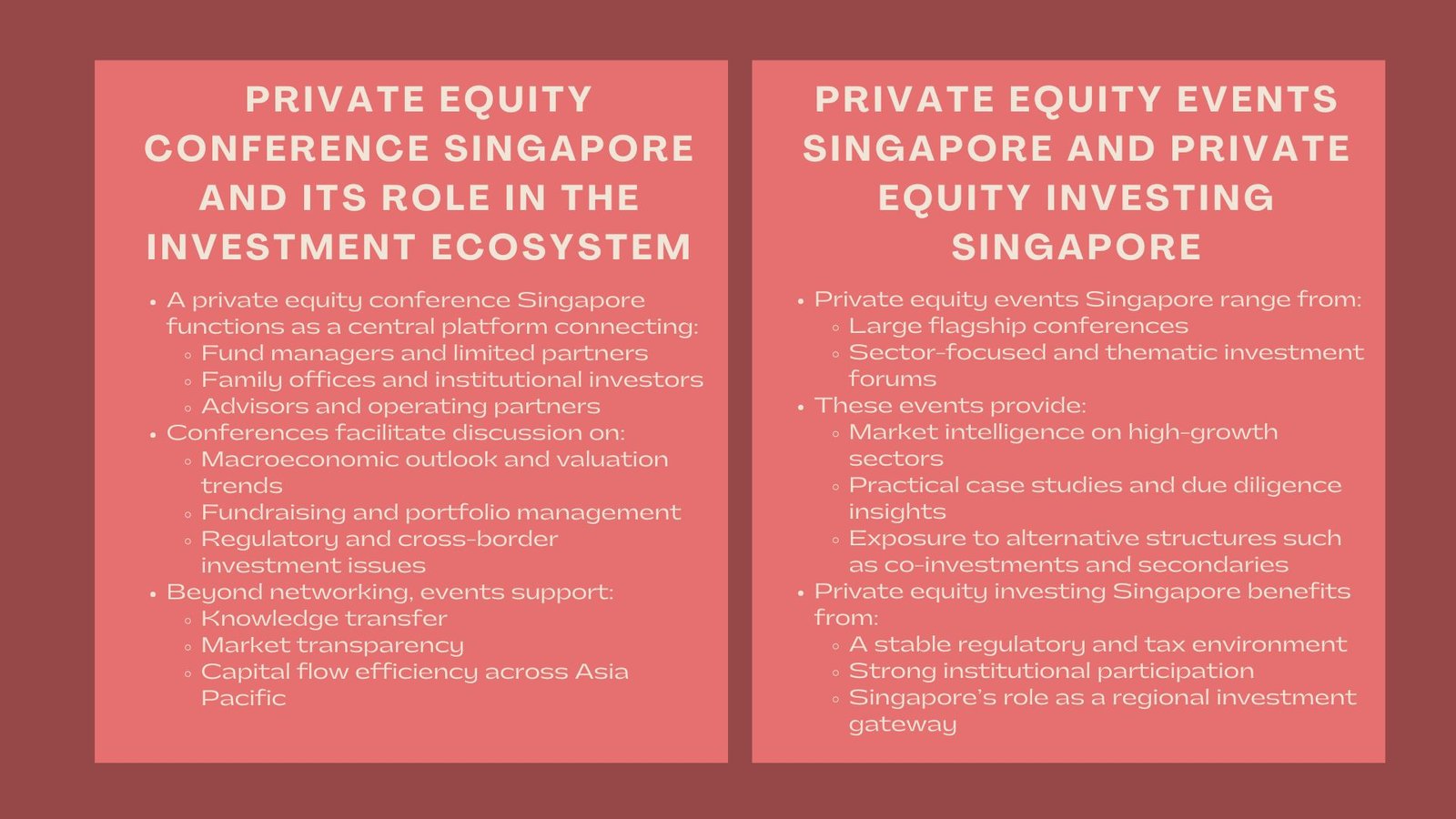

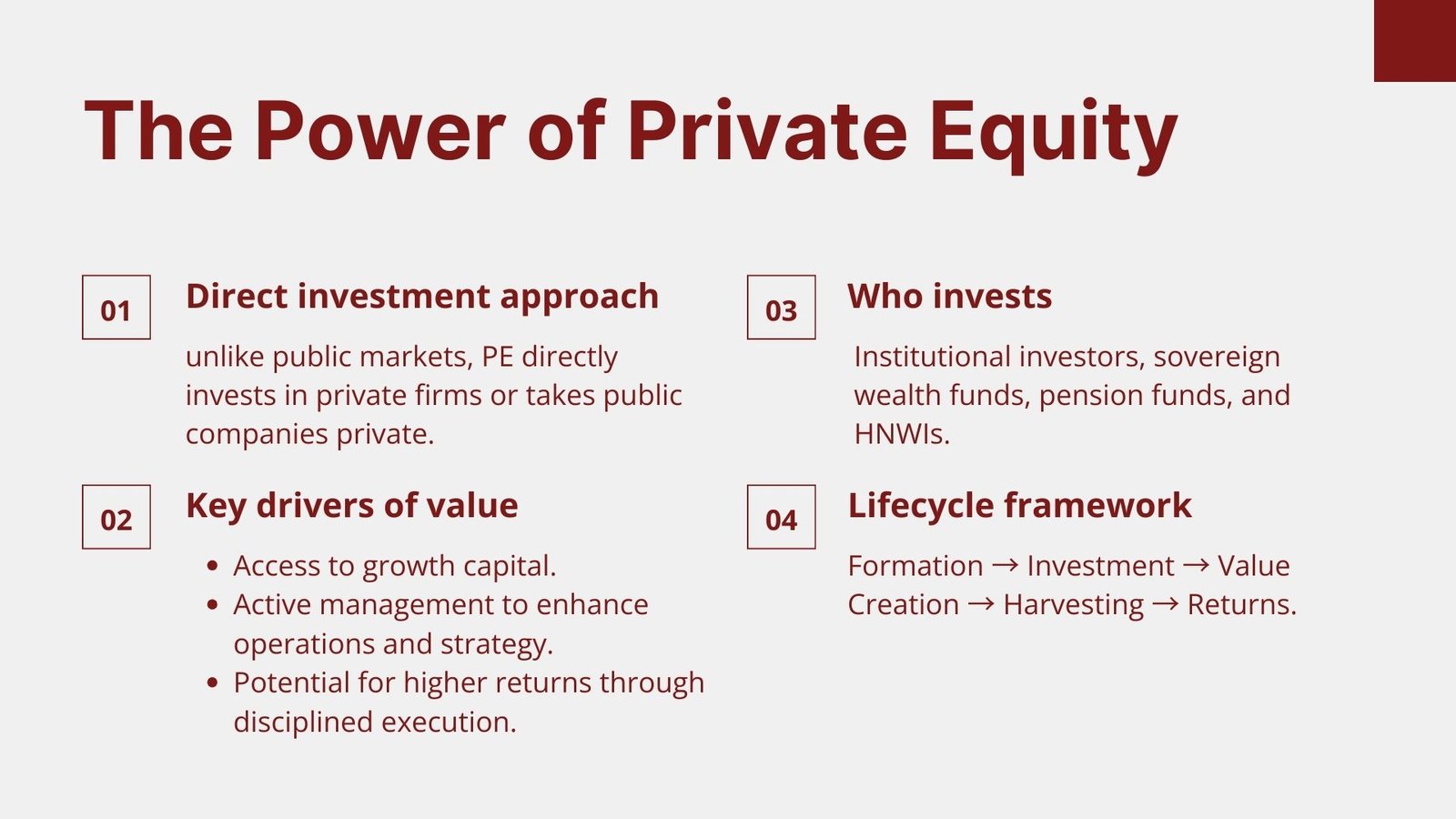

The role of a private equity has become one of the most powerful drivers of the modern world of investments since it proposes an additional capital base that can assist businesses in development, reorganization of their operations, and the extension of the strategy. This is unlike investment in public markets which are traded on a daily basis whereas in private equity there is direct involvement in privately owned companies through direct investment or turning publicly owned companies in the private sectors to enhance their value before a subsequent bailout.

To the project managers, the business executives and the investors, the formation, an investment and harvesting of a private equity is important in understanding the complexity of the process of deal making and capital allocation as well as optimizing the performance. It is a planned lifecycle during which capital is invested, strategically executed, actively financed and finally returned in a well-organized departure process, rewarding the stakeholders.

The attraction of private equity is that it is managed to achieve high returns by active management and strategic business aspects. It gives a chance to investors to become major stakes in firms, which confers not only power but also responsibility in developing the business direction. The value of this active management style sets private equity aside in comparison with passive investments, which is one of the reasons why institutional investors, high-net-worth individuals, and sovereign wealth funds invest a certain percent of money in this category of assets.

The process of gaining insight into the move between fund formation and harvesting is important so that the advantages of this investment instrument can be maximized. For professionals seeking structured learning, the Best private equity course Singapore offers a comprehensive pathway to mastering these concepts. In addition, advanced programs such as Private equity deal structuring training Singapore provide hands-on knowledge for those aiming to specialize in the technical aspects of transactions.

Fund Formation: Structure, Capital Commitments, and Strategy

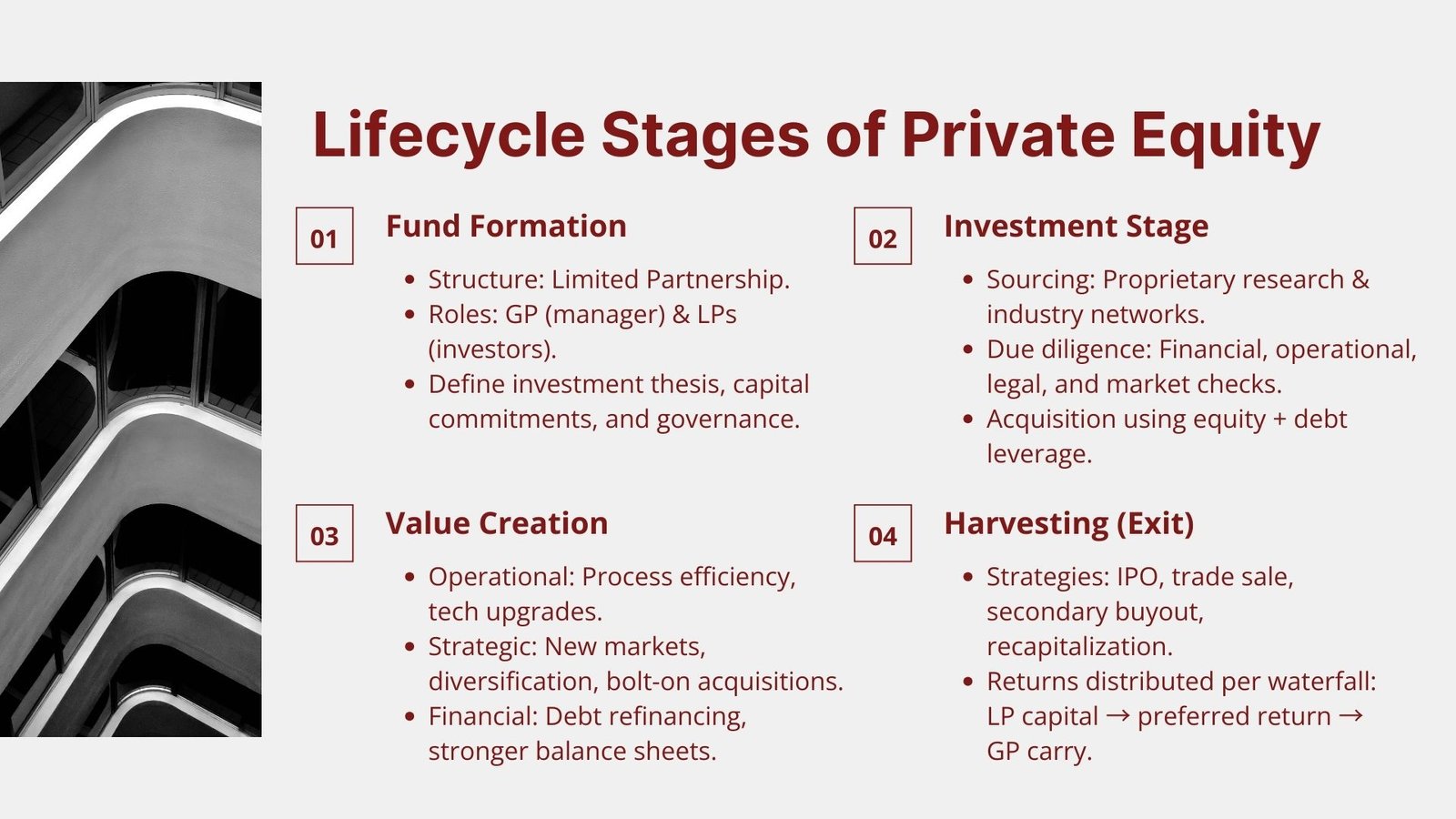

It is the stage of formation of a private equity fund whereby a fund is conceived, structured and capitalized. The initial step in this step is the legal and operational foundation of the fund which is usually established as a limited partnership or similar association that has the benefit of liability protection and tax effectiveness. The fund is run, investment decisions are made and the burden of generating the desired returns lies on the general partner (GP) whereas limited partners (LPs) are the ones who contribute most of the capital but of course with less participation in daily operations.

The fund formulation also includes creation of investment thesis which characterizes which sectors to be invested in, geographies and type of deals to be pursued by the fund. The GP expertise and market analysis and the risk-return objectives determine this thesis. After being defined, the GP initiates a fundraising to find investors that are institutional funds, pension funds, endowments, family offices and accredited investors to commit to capital. These promises do not immediately run down but are intoned in the process of time when investments are realised and put in use.

Notable is that key legal agreements are drawn portraying the rights and responsibilities as well as the way profits are shared between LPs and the GP which include the Limited Partnership Agreement (LPA). Management costs and carried interest conditions are put in place and balanced through costs and performance incentives. It is at this point that GP also determines the duration of fund life also known as fund life, normally around 8 to 12 years that gives a clear horizon to invest, operate and exit portfolio companies. The formation step is very vital in that it sets the governance, capital arms and strategic perspectives that will determine how the fund should move in its cycle.

Investment Stage: Sourcing, Acquiring, and Managing Portfolio Companies

When the fund has been started, the investment phase will occur. This is when the GP feels into target companies with such commitments of capital as dictated by the fund strategy. An initial process of deal sourcing is paramount, whereby industry networks, investment bankers, corporate advisors and proprietary research is used in order to unearth potential deals.

The companies that are commonly the target of the private equity firms are those with good fundamentals but still has latent growth potential, have operating inefficiencies or have some sort of misalignment regarding strategies that active management can correct. For professionals preparing to engage in this stage, resources like a List of finance and investment courses Singapore can provide the foundational knowledge and skills needed to analyze opportunities effectively.

Due diligence forms part and parcel of the investment. The process will entail intensive fiscal analysis, operational assessment, analysis of the market, legal analysis and identification of the risks. It aims at checking that the target company fits within the fund investment thesis and provides satisfactory risk adjusted rate of return. When the opportunity has been satisfied by due diligence then the GP will negotiate the acquisition, using a blend of equity and debt to most efficiently purchase and provide leverage to improve returns.

The work of the private equity firm ends once it has acquired the company and it turns to creating value. This may involve making operational enhancements, a new market entry, a change of management structure, a supply chain optimization and a merger or acquisition. The GP does actively participate in the setting of the strategic positioning of the company, such that business performance should be enhanced over the period of investment. The importance of regular monitoring and performance tracking as well as governance oversight is critical too and the final destination will be to add enterprise value in readiness of the harvesting.

Value Creation: Operational, Strategic, and Financial Enhancements

The value addition stage is the core of the process associated with the taking part in the private equity between injections and harvesting. Respectable results in the area of private equity can be characterized by the capacity of the companies to operate their portfolio firms actively in order to promote quantifiable outcomes. This involves multi-dimensionality that entails operational, strategic and financial knobs.

The operational improvements tend to be concentrated on the maximization of efficiency and productivity. This may involve enhancement of technology systems, flattening processes, providing cost cutting, and increasing the efficiency of employees. The strategic improvements may include a change in the location of the company within the business sector, merchandise diversification, move to new geographic locations, or creating strategic engagements that enhance market coverage. Financial gains can be realized by improving the balance sheet, improved working capital and debt re-financings in order to lower the cost of capital.

It is the duty of the GP to cooperate with the leadership of the company and frequently appointing experienced executives or advisors to the board, who would guide the company toward its corporate objectives and alignment with the fund. There are clear performance measures with accountability systems measures to measure progress. Value creation does not just involve reducing cost but entails developing sustainable growth that would boost the long term perspective and attractiveness to potential buyers during the exit stage of a company.

Harvesting Stage: Exit Strategies and Realizing Returns

Harvesting is the stage at which the private equity fund achieves the growth on its investments as it divests the portfolio companies. This is a vital stage since it factors in the real returns allocated to the LPs and the GP. There are a number of ways to realize exits and there are positive sides of it and some extraneous concerns.

Among the most common strategies, are initial public offerings (IPOs) where the company is listed on a stock exchange, thus generating liquidity and further value appreciation; trade sales, where the firm would be sold to another company in the same sector; secondary buyouts where the asset is acquired by another private equity fund; and recapitalizations where the available funds are refinanced and some of the monies exiting; but remain a part of the ownership.

The exit time is a determinant factor which depends on market conditions amongst other things, the performance of the company and the expectations of the investors. With a predetermined life length to the fund, the GP also must strike a balance between the wish to receive the maximum returns on an investment and payback the capital at the end of the fund. Exit planning can start long before the actual transaction, and the portfolio companies can be primed to be sold by improving performance, building a brand, and strengthening governance.

Upon the completion of an exit the proceeds are then split based on the terms of the LPA, generally with LPs getting their original capital plus preferred return ahead of when the GP gets carried interest. An effective harvesting process does not only bring good returns, but also boosts the track record, which helps the GP in fundraising for future funds.

The Interconnected Nature of the Private Equity Lifecycle

The stages of the creation, investment and collection of the private equity are interrelated profoundly as one stage affects the other. Strategic decisions that are taken during fund formation determine the nature of transactions that will be sought in the investment phase, whereas the success of value generating activities will directly affect the success of the harvesting phase. What fund managers need to do is to remain disciplined, flexible and long-term oriented to overcome this lifecycle.

Investors are progressively questioning not only the financial performance of the private equity funds anymore, but also responsible investment, environment, social, and governance (ESG) factors, and accountability in private equity funds. This puts another dimension on the private equity lifecycle and GPs have to consider incorporating these in their strategies at the earliest.

Of value to project managers and corporate leaders, who are not necessarily involved in the investment industry, is the knowledge of this lifecycle. The practices of capital discipline, performance management, and exit strategy related to the planning of business projects, mergers and other large-stake business initiatives can be applied. Structured investment and value realization is one of the skills that a company needs to perfect in a competitive globalized economy that can result in long term benefits.