Growth Capital vs Buyout Funds Key Differences in Private Equity

Growth Capital vs Buyout Funds: Key Differences in Private Equity

Introduction to Growth Capital vs Buyout Funds Key Differences in Private Equity

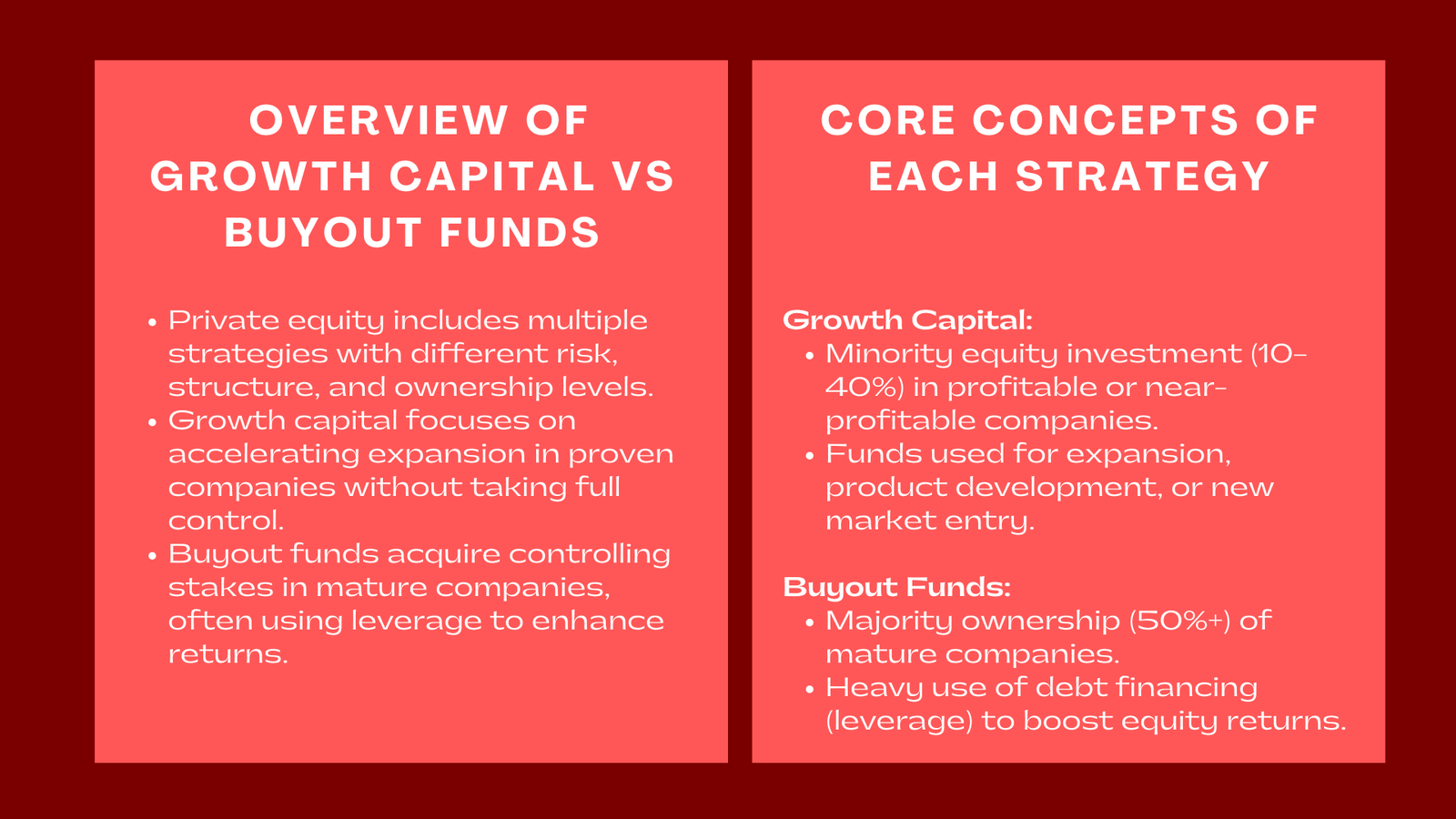

The concept of Private Equity (PE) as an asset class is very broad, and various investment strategies outlined by this approach vary in their structures, goals, and risk levels. Among them growth capital and buyouts funds are two of the most notable types of PE investment. They have some common ground common share of these strategies is to receive equity interests in private companies of the goal to yield higher returns in the long-term, but differ extensively in their deal-structure, intensity of capital, and control, and value-creation strategies.

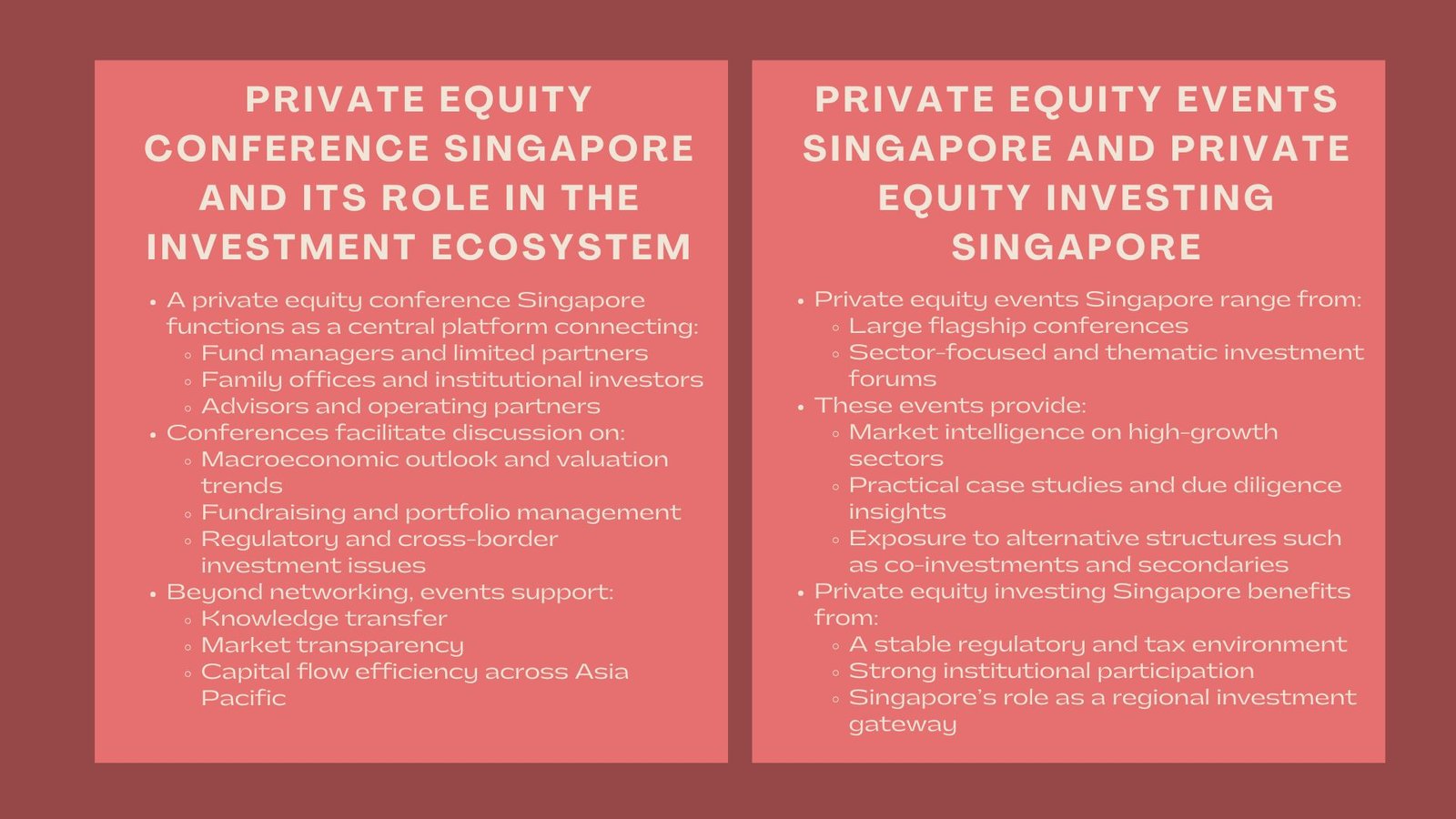

The differentiation of the two financial entities, namely growth capital and the buyout funds, is a vital aspect to investors, analysts and fund managers that plan to allocate funds effectively and those interested in entering careers in this sphere of the financial sector. All forms of investments key differences between growth capital and buyout funds in private equity Singapore have a different role in the corporate lifecycle, where growth capital tries to fast-track the growth of already-proven businesses, and buyouts are aimed at restructuring existing and healthy businesses in virtue of leverage and control.

The paper brings a detailed analysis of these two strategies of investments and the main features of them, their valuation frameworks, and methodology, and strategic designs of the changing environment of global private entrepreneurship.

Understanding the Core Concepts

Defining Growth Capital Investments

Expansion capital, also called growth capital, is minority equity in already existing companies that are aiming at expanding their operations, venturing into new markets, or realising a transformational project without sold ownership. The growth capital targeted companies are often profitable or on the verge of profitability and need an external financing to finance the projects to either develop products or expand to new markets or strategic acquisitions. This topic is also commonly discussed in a private equity course Singapore growth capital and buyout funds context, where investors learn how these strategies differ in structure, risk, and control.

As opposed to venture capital that invests in startups in their early stage and models of revenue are not certain, growth capital is aimed at companies that have demonstrated their track records, sustainable revenues, and the growth perspective. The capital is supplied by the investors who get equity or quasi-equity instruments and they have very little control in the day to day running of the organization. This is because the growth capital investments are primarily driven by the ability to increase revenues and value added over time as opposed to financial restructuring or leverage as the determinant of the principle of purposeful growth capital investments.

Defining Buyout Funds

In contrast, buyout funds are typified by the purchase of the controlling or major share of the companies that are already mature, and a combination of the use of debt and equity is common. A buyout aims at acquiring a company and increasing its performance and eventually exit into a better price. It is a process that normally entails a lot of leverage, operational optimization as well as repositioning strategies.

The buyout model enables the private equity sponsors to have significant corporate governance, financial and management control. Leverage enhances the equity returns that would otherwise occur, but it increases the risks incurred in terms of finance. Buyout transactions therefore require a lot of due diligence, financial modelling as well as risk management so that the acquired party can be able to raise enough cash flows to cover its debt commitments and at the same time increase in value.

Structural and Financial Differences

Ownership and Control Dynamics

The amount of control in the target company is one of the most distinguishing differences between growth capital and buyout funds. The growth capital investors generally buy minor interests in the company, which is between 10 to 40 percent of equity in the company. Therefore they will not take over the management decisions but will be strategic partners to contribute financially and skills involved in the expansion. They involve them in collaboration, based on the harmonisation with the current management teams to spearhead growth programmes.

In contrast, buyout funds are interested in ownership that makes them dictate the corporate strategy and shape decisive decisions. Ownership of control- in most cases more than 50 percent makes the private equity company to institute operational changes, managerial restructuring, and refocus the corporate objectives with the aim of maximizing shareholder value. The buyout type of governance is therefore more active and interventionist than growth capital partnerships which is advisory in nature.

Capital Structure and Use of Leverage

The growth capital and buyout financing structures are also very dissimilar. Growth capital investments are generally financed by fully directing their funds in equity without much or no debt. The reason is the fact that these firms are at the stages of expansion when the reinvestment requirements are great, and the high leverage may limit flexibility or risk. It is focused on organic growth, capital efficiency and scaling operations, instead of financial engineering.

Conversely, buyout funds use leverage to a great extent to employ leverage to increase returns. Debt financing is also usually secured by the assets and cash flows of the acquired company and thus the equity capital outlay is lowered by the sponsor in the private equity. The resultant capital structure balances senior and subordinated debt and equity contribution which allows the investors to maximize the internal rate of return (IRR) whilst exercising risk management by the influence of covenant and performance control. This leverage brings how growth capital and buyout strategies create value in private equity investments Singapore complexity as well as increasing potential returns in case the operational upgrades, and strategizing plans are successfully implemented.

Investment Horizon and Return Drivers

The growth capital investments can be long-term investments with durations of five to eight years which is an indicator of the time the market will be expanded and the product developed. The revenue growth, expanding the margin, and valuation re-rating upon exit are the major drivers of returns. The success will lie in the successful implementation of its growth strategy by the company and the ability to maintain competitiveness in the dynamic market.

Buyouts on the other hand have shorter to medium term investment horizons both in terms of activity, cost savings as well as financial restructuring. Leverage, cash flow management and exit multiples play a very crucial role in the return profile of the buyouts. Its two-pronged strategy of optimizing the performance and decreasing debt increases the value of the equity as well as investment returns.

Valuation and Analytical Framework

Growth Capital Valuation

The growth capital investments are done at valuations that focus on the future growth prospects of business and not its profitability today. Discounted cash flow analysis (often referred to as DCF) models, scenario-based forecasting, and similar analysis of companies are often used to establish fair value by analysts. Since such investments tend to deal with minority shares, pre- and post-money equity valuations often become the subject of the negotiation of valuation, with an eye toward how such a decision may lead to dilution and the equity exit preference.

Risk-adjusted returns expectations are also aspects that should be taken seriously in growth capital valuation. The little leverage implies that it is no longer about the projection of realistic revenue prospects, scaling comfort, and exit values estimation depending on the forecasted market conditions. Sensitivity analysis is heavily utilized in a bid to know how the changes in the growth rates, margins, or capital expenditure will affect the returns that the investor is likely to get.

Buyout Valuation

A valuation analysis in buyouts combines operation performance as well as capital structure in buyouts. The most important measure is the EBITDA multiple that is usually taken as a surrogate to the value of the enterprise. Analysts construct complicated leveraged buyout (LBO) models which model debt repayment plans, interest coverage, and equity worth development under varying conditions. Leverage magnifies possible IRRs but also necessitates stress testing that should help make sure that the firm can service the debt even in negative circumstances.

A buyout valuation can thus represent the calculation of the both entry price (purchase price multiple) and the exit value usually in a period of five years. The achievement within the investment is based on the potential of enhancing enterprise value by means of operational enhancement, multi-expansion or strategic divestitures. The analytical rigor of business valuation of buyouts is related to the balance between leveraging optimization and business improvement.

Implementation in Private Equity Practice

Operational Involvement and Value Creation

In growth capital investments, the work of the private equity firms is that of a supporter, co-operating with the management in order to realize the growth potentials. They can help in the strategic planning, venture into new markets, or the enhancement of the financial reporting systems. It is a partnership relationship and not a controlling one. The value creation is achieved by facilitating the management teams to operate efficiently, using the investor network, capability and extra capital facilities.

Buyout investors on the contrary are more hands-on. They usually introduce organizational restructuring, cost-cutting policies, and realignment in the organization once they gain control. They can either replace their top managers, to initiate performance based rewards or engage in acquisitions and mergers as a way of creating a stronger market presence. Such an active form of management will guarantee compliance with the strategic goals of the fund and increase accountability in the portfolio firm.

Approaches to Exiting Investments

Growth capital and buyout funds have the same intentions of making a profitable exit, yet their processes may be dissimilar. Growth capital investors usually sell away their interests by making strategies of sale or secondary sale or initial public offering (IPOs) when the company matures or when it is painfully important by admiring the desired valuation. Since they are minor shareholders, the exit will usually be subject to the liaisons with the majority shareholders or founders.

Since buyout funds hold a majority, their chances of exit timing and structure are higher. Typical representations of exiting will be trade sales to corporate acquirers, secondary buyouts by other private equity funds or IPO. The decision to exit is also planned at strategic time when it coincides with best valuation cycles and preferable market conditions and the most returns are received by limited partners (LPs) and general partners (GPs) as well.

Analytical Overview and Strategic Considerations

Risk Profile and Portfolio Diversification

The growth capital investments are typically viewed as moderate-risk investments as they provide a compromise between the high risk of venture capital and high leverage exposure provided by buyouts. Lack of a high degree of debt lowers the downside risk, and the possibility of high growth gives desirable upside potential. To institutional investors, the growth capital will be a portfolio diversifier comforting them with consistent returns and with the growth prospects of other emerging sectors like technology, healthcare, and consumer markets.

Buyouts funds, on the other hand, will fall on the other extreme. The economic cycle and interest rates are more sensitive as the company operates at a high leverage level. Nevertheless, the control system can be directly intervened to control risks and guide the performance of the company. These risks are eliminated by experienced buyout managers using strict due diligence, strict capital allocation, and active governance.

ESG Integration and Evolving Market Trends

Environmental, social, and governance (ESG) issues are becoming prominent when it comes to both growth capital and buyout strategies. Growth capital investors are interested in sustainable growth model and positive contribution to society which fits in the preferences of the long term investors. Buyout firms, in their turn, are incorporating the ESG frameworks in the operational governance and portfolio management with the objective to satisfy the requirement of the institutional investors towards responsible investment.

The change in technology is also transformative in the two segments. The analytics of data and digital platforms and automation have improved the deal sourcing procedure, accuracy of due diligence, and monitoring of the post-investment. The convergence between technology and finance allows the investors to assess the business strategies defined more dynamically, which enhances the accuracy of the value-creation strategies.

Key Benefits and Industry Impact

The presence of the growth capital and buyout funds are complementary to the entire ecosystem of the private equity. Innovation and growth develops on growth capital, with industries and enterprises dependent on this capital to drive the expansion and growth of an economy, and generate jobs. Buyouts on the other hand, makes the mature industries become efficient as a result of optimization of Canadian capital structures and renewal of non-performing businesses.

Institutionally, these two strategies are combined in diversified PE portfolios. The growth capital has stable compounding returns with reduced leverage risk whereas the buyout funds have high returns prompted by control and leverage. They both play a role in the overall mission of private equity, which is to turn capital into long-term enterprise value.

Conclusion

Two separate types of pillars in the industry of private equity are growth capital and buyout funds. Although they both tend to achieve higher returns as a result of their ownership in the privately operated businesses, they differ in the basic way of thinking, control, furnishing structures as well as value-creation patterns. Growth capital is more partnership based, organic expansion, and scalability over a long period whereas buyout is a more control-based restructuring and leverage-based financial optimization approach.

With a changeable environment in the global financial scene, these differences are very crucial to the investors and other professionals who want to strategize when investing in the field of private equity. Due to the changes in the dynamics of investment as ESG standards, technological innovation, and macroeconomic volatility transform the processes of forming capital strategy, the capacity to synchronize the capital strategy with corporate lifecycle becomes more and more important. Finally, the strategic motivations of both growth capital and buyout funds are the same: the development of long-term value, not only by using financial facilities, but also by strategic thinking, operational excellence, and capital responsible management.