Common Mistakes in Private Equity Investing and How to Avoid Them

Common Mistakes in Private Equity Investing and How to Avoid Them

Introduction to Common Mistakes in Private Equity Investing and How to Avoid Them

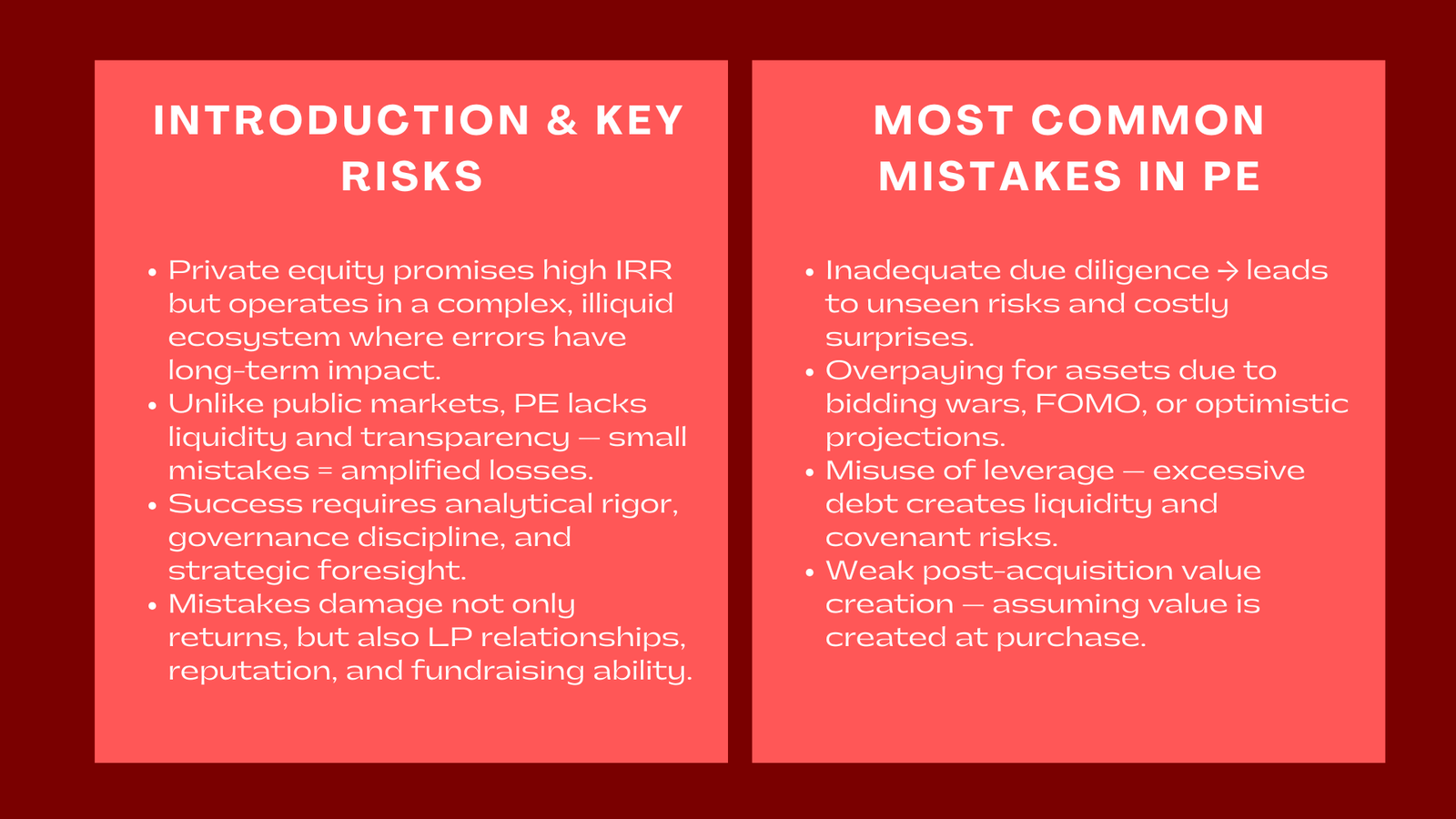

Private equity (PE) investing has been closely associated with many positive myths: a sophisticated and potentially high yielding asset class with the ability to generate enormous returns through smart acquisitions, financial engineering and operational optimization. However, while double-digit internal rates of return (IRR) is an attractive claim, behind the numbers hides a complex ecosystem, where one can be easily and long-term killed by false assumptions. Unlike the public equities, which shield against poor decisions by virtue of liquidity and transparency, private equity is temporary in nature, concentrated ownership and with difficult value-creation processes. As a result, any small mistakes in judgment or execution can result in the large amount of underperformance.

Equilibrium in PI: In addition common mistakes in private equity investing and how to avoid them Singapore chooses the correct goals, for associations dealings to raise assets and meet investee needs, a mix of structure, portfolio organization, and strategic exits is key in private equity. Given the illiquid and levered nature of PE, both upside and downside are amplified, which means that investors have to exercise deep analytical rigor, strategic foresight and governance discipline. This article outlines the most frequent errors that have proven to destroy private equity performance and provides strategic pointers to avoid them – ensuring that investment decisions are strategic with regard to long-term value generation and institutional integrity.

The Complexity of Private Equity Investing

A Multi-Stage Process Requiring Precision

Private equity is not a one-shot investment activity that involves deal sourcing, due diligence, structuring, post-acquisition management and exit. Each stage requires specific expertise, powerful analytical frameworks and constant vigilance. An error in any of these steps is a misstep that can result in losses in the cash or missed opportunities.

Unlike public market investors, private equity professionals aren’t able to use liquidity in the market to correct the mistakes, or reprice the assets. Once committed, capital is tied up for years, with not so much room for reactive decision-making. As a result, missteps in valuation, structuring leverage or in the operational implementation may be missteps that are not limited to one investment but rather, affect the performance of the overall fund. The complexity and length of private equity requires an acute and anticipatory approach to all stages of the investment life-cycle.

The Cost of Errors in PE Decision-Making

The impact of private equity mistakes is not just limited to mere monetary loss. This can lead to relationships with limited partners (LPs) being damaged, institutional reputation being tarnished and future fundraising capability being impacted. Paying too much for assets, underbooking risk or failing to govern the transaction can cause liquidity strains and reputational damage which requires years to mitigate.

The leading PE companies learn it can be much more expensive to remediate than to prevent. Understanding the cyclical nature of setbacks in the industry enables investors to develop effective decision frameworks to ensure that capital is invested in a responsible and efficient manner.

Common Mistakes in Private Equity Investing

Inadequate Due Diligence

The primary reason behind failure in PE is that the due diligence ends up being insufficient or poorly implemented. The trade off in a competitive deal process between time and quality often leads some investors to put off the analysis and concentrate narrowly on the financial statements while ignoring the operational, legal, or market aspects. This shortcut can result in expensive post-acquisition surprises – from regulatory glitches to operational inefficiencies to culture clashes. For this reason, many professionals now pursue a due diligence course Singapore for private equity to strengthen their evaluation skills and avoid costly oversights.

Due diligence should be composed not only of quantitative but also qualitative evaluation. It’s all about in-depth research of business models, market trends, supply chain dependencies, customers’ behaviour, competitive positioning. In addition, management due diligence is also important to understand the integrity, capability and alignment of leadership. Risk is reduced, assumptions are validated, and the groundwork for achievable value-creation strategies is built.

Overpaying for Assets

Valuation discipline is still one of the most important factors for success in private equity. Paying too much for each item obtained – whether due to competitive bidding wars, undue optimism, fear of missing out, etc. – can permanently jeopardize returns. Once you have bought something overpaying for it, even IRRs associated with substantial operating improvements may not achieve the target level.

An approach that is based on intrinsic value analysis and research, not market excitement, is the only way to avoid overvaluation. Conservative modeling, sensitivity, and scenario planning to ensure the price paid is justified by the projected cash flows that can be anticipated. Successful investors are patient and will walk away from overpriced deals instead of making short-term concessions to return integrity. In private equity, deal volume is less important than discipline.

Misuse of Leverage

Used correctly, leverage maximizes equity returns by maximizing capital capital efficiency. However, unstructured or excessive leverage (i.e. collateral mismatches) can turn a promising investment quickly into a troubled asset. As the portfolio companies rely mostly on debt, liquidity risk is intensified when macroeconomic conditions change or cash flow projections turn out to be weaker than expected.

The core of avoiding this error is to adjust leverage levels in line with the capacity of the cash generation of a company, the cyclicality of the industry and the stability of the operation. Financial models should perform stress tests of interest coverage and covenant laws across different economic situations. Sustainable leverage is not about finding the maximal debt, but getting into the right debt to balance maximizing on return with long-term sustainability.

Neglecting Post-Acquisition Value Creation

Amongst the commonest myths of private equity are that value is created at the acquisition. Factually, the act of acquisition only opens the possibility to create values; the actual act comes later. Failure to engage in post acquisition, be it passively through the ownership itself or lack of controls over the performance can cause missed opportunities and drift of strategy.

An understandable value-creation plan must be set prior to the closing of the deal. This entails state of operations improvement, margin improvement efforts and growth opportunities. Close interaction with the management teams, periodic review of performance, and structures of accountability will make the investment thesis translate into concrete results. The most successful funds consider portfolio management as part of a discipline which is done continuously and in a hands-on way and not an administrative job.

Weak Governance and Oversight

Many of the setbacks of the field of private equity have been founded on the problem of governance failures. Weak board structures, lack of clarity are the process of making decisions and lack of proper oversight may result in operational inefficiencies or the lapse of ethics. In other situations, the private equity investment risks and best practices for investors Singapore sponsors assume the control being automatic in the case of the majority ownership without the formalization of the governance systems.

The governance should have clear accountability structures which must be established at the onset of the governance. This involves hiring of independent, experienced board members, performance measures, and transparency by doing regular reporting. Effective governance does not interfere with the independence of management; it allows its leveraged decision making, risks management and long term alignment of the stakeholders on a long term basis.

Misaligned Incentive Structures

Harmonization of interests between the sponsor of a private equity and the management of a portfolio company is basic to value-generation. Misalignment is used when the compensation structures do not align positive rewards towards performance results. In case the financial interests of the management are not linked to the appreciation of equity or the achievement of operations, the motivation and accountability is negated.

To eliminate this, PE firms establish incentive systems that have everyone on the same goals. Equity that is based on performance or on profit sharing schemes and bonuses based on milestones all make sure that the management shares in the risk of success as well as in the success itself. Cohesive incentive systems promote the spirit of ownership and promote strategic implementations rather than short-term profits.

Poor Exit Planning and Timing

Even a well-performed investment process can fail in case of untimely exit or when not properly planned. Premature exit can risk foregoing any value creation and delayed exit can subject the company to recessionary economic slumps or strategic stalemates. Also, preparation to be sold, including unfinished paperwork, unaddressed business problems may decrease valuation and trust in the buyer.

Good management of exit starts with the acquisition, and the exit management of the company should have a well-established roadmap of all possible exit strategies, which could be trade sale, secondary buyout, or an IPO. It is planned to constantly revise this strategy according to the tendencies of the market, its performance rates, and the desires of the investors to be ready when the time of opportunity comes. The finest exits are not made by chance but through a methodical effort to have them planned.

Frameworks for Strategic Analysis

Embedding Analytical Rigor

Various disciplines of analytics are core to successful investing by a private equity company. Companies that establish strict methods to undertake financial modeling, risk analysis, and validity of the value of such values minimize the likelihood of making strategic mistakes. Internal review, independent audit and investment committees conducted on a regular basis ensures that their decisions are not based on an intuition or competitive impulse.

Furthermore, the institutional memory and resilience are supported by the constant learning based on the past investments with the success and unsuccess of the investments. Through standardization of post-mortem studies, companies will be able to enhance methodologies and build strong decision-making systems as time goes by.

Prioritizing Risk Management

Risk management in private equity is not something that is done after. Risk identification, quantification, and mitigation should be implemented at all levels, including the identification of the deal, up to its exit. This would involve measuring macroeconomic exposure, changes in regulation and industry specific strengths and weaknesses. The risks associated with downside can be mitigated by keeping liquidity reserves, designing flexible financing and diversification of portfolios in terms of the sector and geographies.

Those successful private equity managers do not think of risk as a constraint, but a dimension of opportunity that has to be analysed and managed to create asymmetric returns.

Leveraging Technology and Data Analytics

Technology is now taking a radical change in avoiding the time-honored blunders in investment. With more advanced analytics, machine learning, and automation, the activities that a private equity firm conducts in the due diligence can be done more accurately, anomalies can be identified, and performance can be predicted more precisely. It is possible to identify the poor performance in real time through a system of tracking the portfolio and therefore take timely corrective measures.

Premediation, scenario modelling and post acquisition supervision is crucial in improving speed as well as precision in decision making by the private equity firms by incorporating the digital tools in the valuation process. This integration of both human instinct and instant is the new judging standard in the management of investments.

Integrating ESG and Ethical Governance

The negligence of environmental, social and governance (ESG) issues has become an important blunder in the present day investment world. ESG lapses may cause reputational risks, control fines, and poor financial performance. On the other hand, incorporation of ESG principles in the investment strategies increases the sustainability and value generation over time.

Companies who are ethical in their governance and have reporting mechanisms are responsible to both the investors and the society. ESG becomes no longer peripheral, but rather it is a strategy requirement, which supports risk management, brand value, and organizational legitimacy.

Value Creation and Systemic Impact

Common mistakes are not just avoided, but institutional excellence is created. Capitals that show consistently high levels of discipline in investment attract more levels of confidence of limited partners and competitive edges in raising funds. The portfolio companies receive superior strategic direction, improved governance and global expertise.

At the macro level, responsible and disciplined practices in private equity helps to stabilize the economy and innovation by the corporations. They promote effective allocation of capital, reinforce employment and promote competitiveness in the market. This way failing to make errors is not just a self-protective approach but an initiator of an environmentally-friendly development of the industry.

Conclusion

One of the most potent value-creation tools of global finance is still private equity, though the volume of its obligations is high. Discipline, analysis, and integrity will help avoid the most common errors, which include, but are not limited to insufficient due diligence, overvaluation, heavy leverage, poor governance, and bad timing.

The future of the financialness of private equity lies up to companies that will integrate financial insight and competence with ethical leadership and decision-making and significant operational achievement. With help of analytical rigour, use of technology and keeping the stakeholders aligned, investors can turn the traps on there to become strategic strengths.

After all, it is not only about not having blunders in the realm of the private equity making, it is about learning how to make decisions in an unpredictable world, and making sure that every move the enterprise makes will not only result in financial performance, but long-term enterprise value and continued growth.